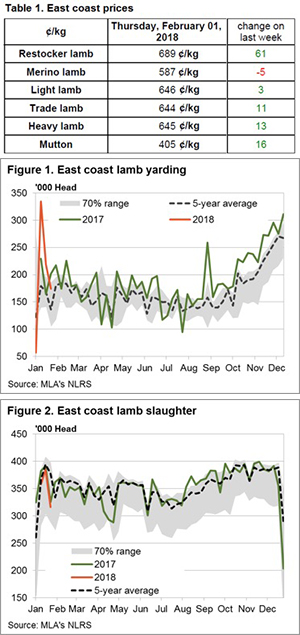

It was another unusually steady week for lamb prices, as supply seems to be closely matching demand. Mutton prices found some strength however, especially in NSW, but regular readers will know this was not unexpected.

It was another unusually steady week for lamb prices, as supply seems to be closely matching demand. Mutton prices found some strength however, especially in NSW, but regular readers will know this was not unexpected.

The thing about writing market analysis weekly is that no one really remembers the predictions you made unless they are particularly bold. This is both good and bad. Good when you get it wrong, bad when you get it right. At least we have the opportunity to remind readers when we were right.

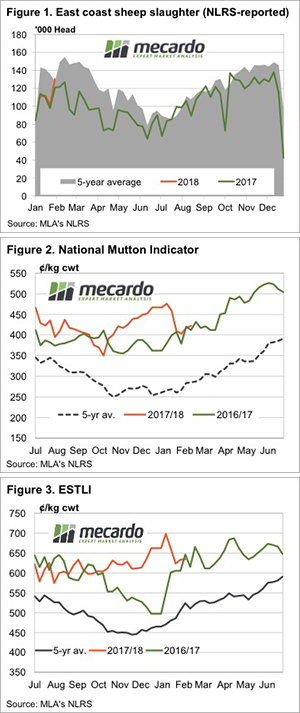

A couple of weeks back we surmised that after Australia Day demand for lamb wanes, more kill space might open up for mutton, boosting prices from what were three month lows. Figures 1 and 2 show that we actually got this one right.

East Coast Mutton Sheep Slaughter rose to levels not seen in two years, and the extra demand has dragged the National Mutton Indicator 20¢ higher over the last two weeks to sit at 422¢/kg cwt.

Most of the mutton action was in NSW, where the indicator is at 430¢, and WA which has the highest prices sheep at 456¢/kg cwt. Sheep in WA are 45% above the same time last year.

Lamb prices tracked sideways this week, with the ESTLI stalled at 634¢/kg cwt (figure 3). Lambs are more expensive in Victoria, at 659¢, and cheaper in NSW at 630¢. SA prices have recovered following the summer flush, and the decline in slaughter capacity, now sitting at 596¢/kg cwt.

The week ahead

Figure 3 shows that on average lamb prices are likely to track sideways to slightly higher at this time of year. There is a risk prices could fall if the dry weather continues, especially in the parts of NSW where they might expect rain at this time of year. On the other hand, a good widespread rain might see enough tightening to rally values back above 650¢. There is nothing on the map for the next week, so expect steady lamb and mutton prices for the next week or so.

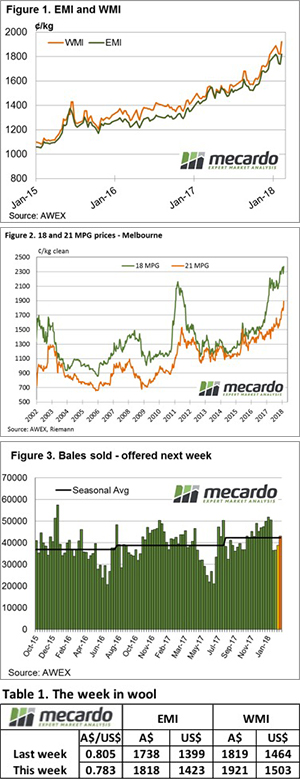

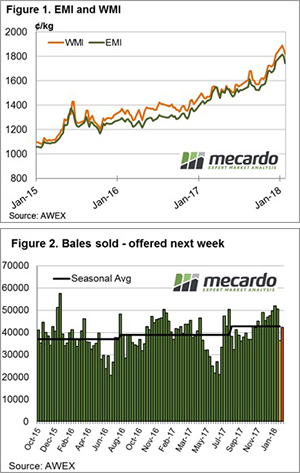

This AWEX report probably summed up the sentiment of the wool market this week – “The recent wool market decline halted in stunning fashion”. Every one of the AWEX reported indices posted an improvement, some of the increases had to be seen to be believed.

This AWEX report probably summed up the sentiment of the wool market this week – “The recent wool market decline halted in stunning fashion”. Every one of the AWEX reported indices posted an improvement, some of the increases had to be seen to be believed.

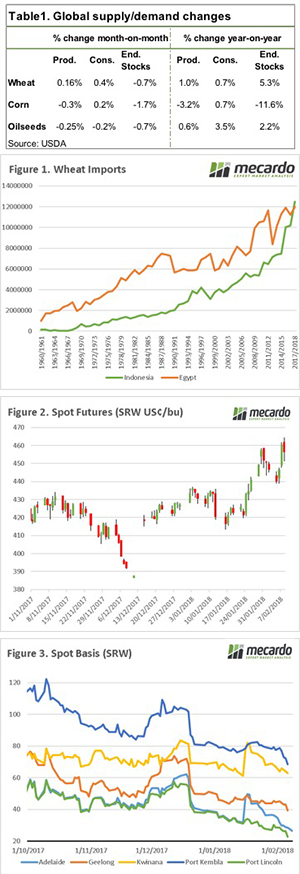

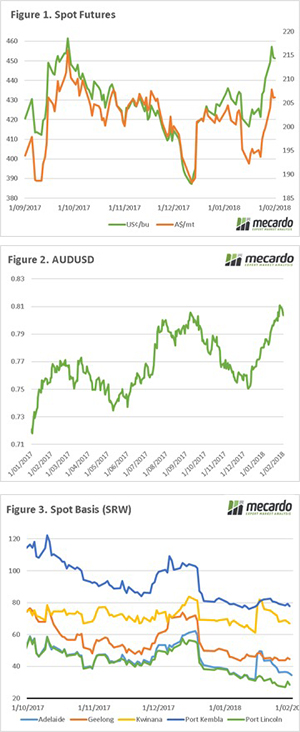

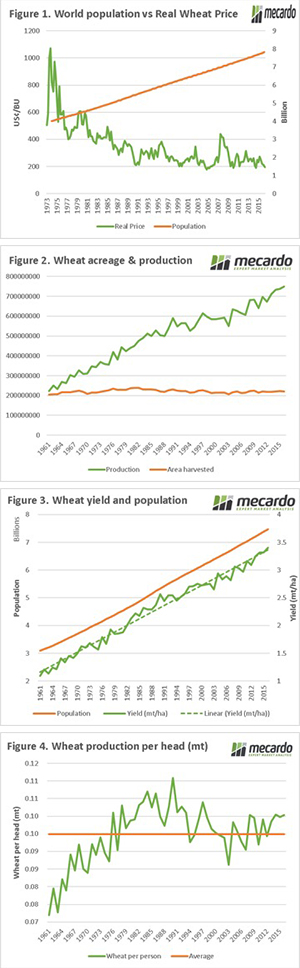

An exciting week in markets, with volatility across equities and currency. In the past week wheat futures have performed well, but has the benefit been passed onto local growers? Overnight the WASDE was released, and it provides some data that is good for Australian grain in the long term.

An exciting week in markets, with volatility across equities and currency. In the past week wheat futures have performed well, but has the benefit been passed onto local growers? Overnight the WASDE was released, and it provides some data that is good for Australian grain in the long term.

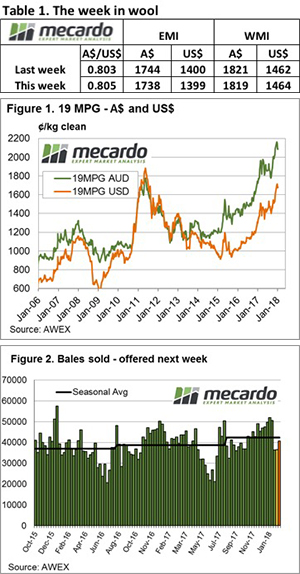

This week the wool market appeared to draw breathe after the sharp falls of the previous two weeks. It was the fine end that fared the best, and of note was the strong competition for sound wool with low mid-breaks.

This week the wool market appeared to draw breathe after the sharp falls of the previous two weeks. It was the fine end that fared the best, and of note was the strong competition for sound wool with low mid-breaks.

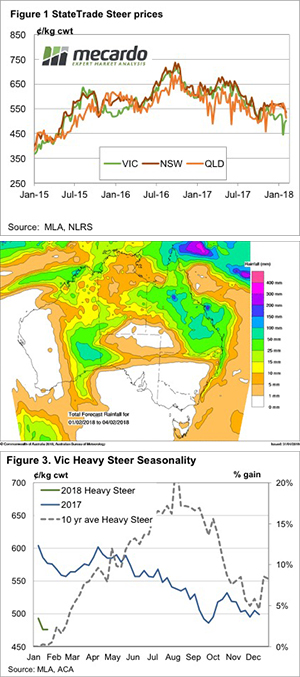

Time flows like water down the river rapids, we are now into February and the holiday season is now but a distant memory. January has come to an end, and it’s worth examining how the start of the year has gone.

Time flows like water down the river rapids, we are now into February and the holiday season is now but a distant memory. January has come to an end, and it’s worth examining how the start of the year has gone.

There was a bit of rain about in the south this week, and the markets stopped falling, and even gained some ground in some categories. There is good rain forecast in Queensland over the coming week, so we might expect a bit more upside.

There was a bit of rain about in the south this week, and the markets stopped falling, and even gained some ground in some categories. There is good rain forecast in Queensland over the coming week, so we might expect a bit more upside.

The wool market took a bit of a hit this week with most categories losing ground, with the exception of the very fine end. Cardings were hit particularly hard with the combined average fall for all three centres coming off nearly 200¢.

The wool market took a bit of a hit this week with most categories losing ground, with the exception of the very fine end. Cardings were hit particularly hard with the combined average fall for all three centres coming off nearly 200¢.