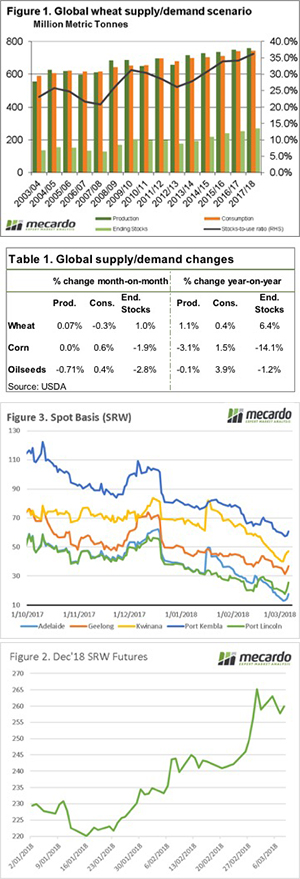

It’s been an interesting end to February, providing reasonably strong increases in futures prices. Overnight the WASDE report for March was released, has it provided any fire?

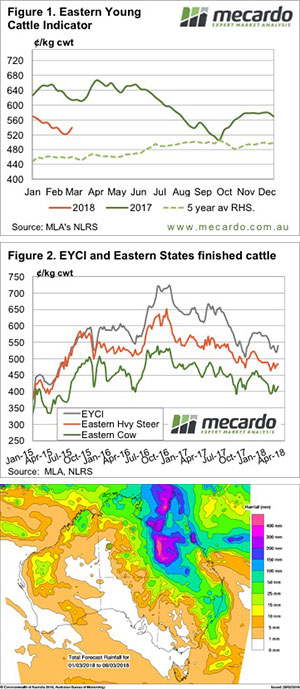

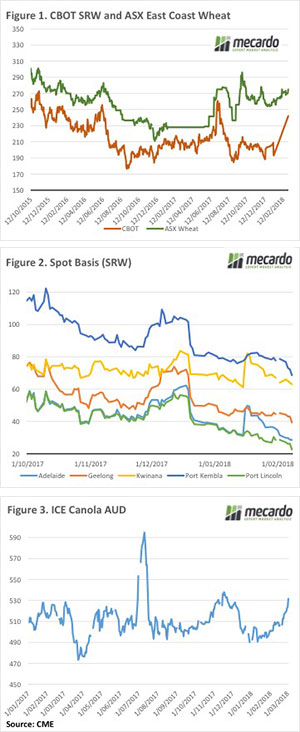

The USDA have yet to switch over to forecast the coming crop, therefore at this point in the year the potential for large changes is limited. The main takeaways from the report, were a continued increase in end stocks for the 17/18 season to 268mmt (figure 1).

The report was largely neutral to bearish for wheat. The story for corn was somewhat more bullish, with South American weather woes leading to a 7.7% production fall in Argentina. The end stocks are forecast to end 14% (table 1) lower than last season, and the lowest since 2013/14.

The futures market has provided some good increases in value for producers in the past three weeks, but last week the market has traded in a directionless band whilst the trade awaits potential rains. In figure 2, the December futures (in A$/mt) is displayed. At present, the pricing level has provided better opportunities for locking in profitable prices for the approaching harvest.

What about basis? Well as expected premiums have fallen dramatically since harvest (figure 3). In past analysis articles, we have pointed towards the record levels and the likelihood of a correction. This has led to our prices at a flat price remaining relatively flat, as futures increase, basis levels fall.

Our article outlining our strategy in October, would have worked perfectly for producers this year. We advocate that producers move away from flat pricing and look to lock in component pricing separately to ensure that little is left on the table.

Lock in premiums, keep exposure

What does it mean/next week?:

It will be interesting to see if there are any reactions to the Trump tariffs. Will this lead to a trade war which could begin to envelope agriculture commodities?

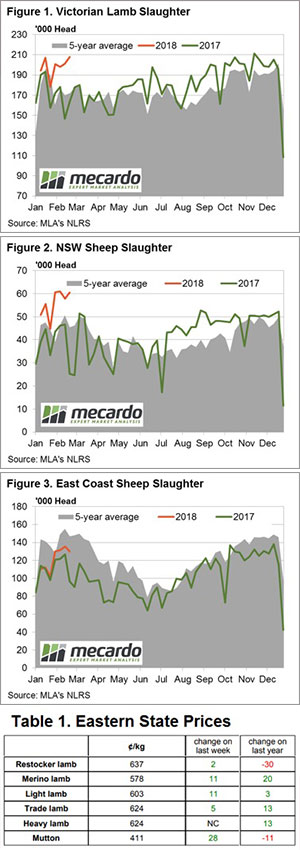

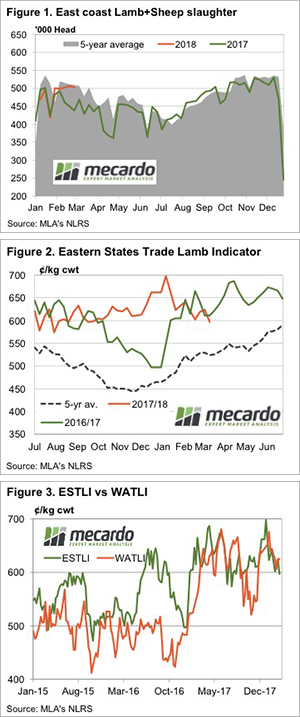

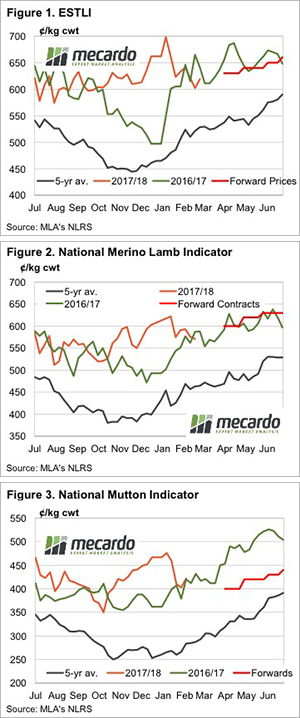

Earlier this week the first forward contract prices for lambs and mutton for the April to July period were released. While there were few surprises on the pricing front, it’s worth taking a look at the values, and how they compare to historical price movements, and where prices were last year.

Earlier this week the first forward contract prices for lambs and mutton for the April to July period were released. While there were few surprises on the pricing front, it’s worth taking a look at the values, and how they compare to historical price movements, and where prices were last year.