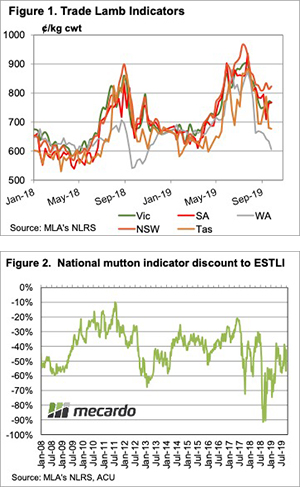

Lamb prices continued to track along sideway in east coast markets, but there were some wild swings in the remote states. The Eastern States Trade Lamb Indicator (ESTLI) slipped below 800¢ for the first time since May, but things are worse in Tasmania and WA.

NSW has held a strong premium in saleyard trade lamb prices for the last month, and little changed this week. NSW trade lambs are carrying the ESTLI, sitting at 823¢/kg cwt, while the ESTLI is at 796¢. In Victoria and SA trade lambs are dragging the ESTLI down, sitting at 767 and 768¢/kg cwt respectively.

It is likely the difference between NSW and southern states is quality related. There are plenty of sucker lambs in NSW yards, while the smaller numbers in Victoria as being depressed by small pens of old season lambs.

Figure 1 shows that trade lambs in Tasmania tanked, losing 182¢/kg cwt over the course of two weeks. Yardings are small in Tasmania at the best of times, and this time of year they are even smaller. With Meat and Livestock Australia lacking quotes for over the hooks lambs in Tasmania it’s hard to get a handle on prices, but the very large discount to Victoria can’t last long.

Tasmania might have cheap lambs, but they had the second most expensive mutton this week. The Tasmanian mutton indicator sits at 557¢, a small discount to NSW which was at 578¢.

WA lamb prices continued to decline this week, heading towards 600¢. With strong export demand, we would expect lamb prices to be better in the west, and they are now at an abnormally large discount to SA.

Next week

The bounce in mutton prices this week took its discount back to the top of the 12 month range (figure 1). This might add a little pressure to mutton values, especially with forecasts for a hot dry spring to come.

Lamb slaughter continues to climb, but demand seems to be keeping up, holding prices steady. The southern supply flush is still to come, which should bring with it a seasonal price low. It might not be too much lower however.