A welcome sound not heard for a long time is being heard throughout large parts of NSW & QLD. The noise of raindrops hitting roofs. This week we cover a few factors from overseas impacting on markets including Egyptian purchases, Russian intervention, and the phase 1 deal.

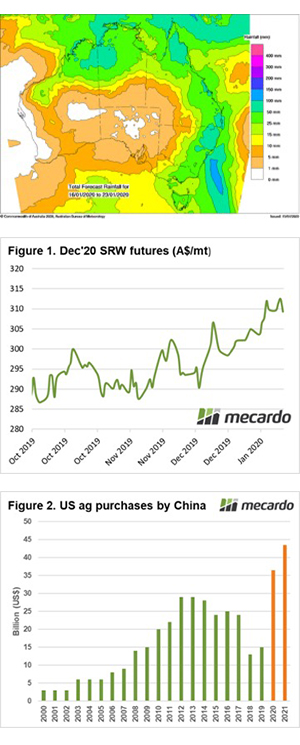

In recent months weather forecasts have consistently tantalized without providing much (see map). Last week strong rainfall was forecast for large parts of the country, and like the boy who cried wolf – I didn’t believe the forecasts. As time flowed this one seemed to be coming to fruition, but I had been tricked into a false sense of security before.

To my delight, this one has delivered for many. Although this rainfall event would have been more welcome four weeks ago for the summer crop, it has provided a good dump of rain throughout the drought-ridden east coast. Let’s not get too cocky though, we’ll need a little more rain to guarantee a good 2020 crop.

Let’s start with the global market. At the end of last week, the Chicago futures market rallied as Egypt bought 300kmt of wheat, at the highest price since February. This volume was unsurprisingly black sea origin however provided a bullish sentiment for overall pricing.

Russia also assisted with the price rise by intervening in their markets. A new export quota limiting grain exports to 20mmt for the first half of the year was enacted. This caused some concern as interventions by what is now the world’s most important grain exporter could have ramifications for trade flows.

Relations between China and the US seemed to be thawing this week, as both countries agreed to a phase 1 trade deal. This deal is a starting point in improving trade between the two super powers, including the agreement to purchase an increased value in agricultural produce over the next two years.

In the agreement China are set to purchase $36.5bn (A$52bn) in 2020, and $43.5bn(A$63bn) in 2021. To put the scale of the increase in perspective during 2017 China purchased $24bn (A$35bn) in agricultural produce from the US (figure 2).

There is a lot of conjecture at present related to which commodities China will purchase in order to increase their value purchased.

The trade wasn’t overly impressed by the deal as it didn’t contain much detail in regards to products purchased, and included a market value clause:

‘The Parties acknowledge that purchases will be made at market prices based on commercial considerations and that market conditions, particularly in the case of agricultural goods, may dictate the timing of purchases within any given year.’

The big concern for me is that in order to meet these purchase requirements is that the trade flows may prioritise US as an origin for many agricultural commodities.

Remember to listen to the Commodity Conversation podcast by Mecardo

What does it mean/next week?:

The rain is set to continue through many parts which will provide some confidence for the coming crop. This must be tempered by the reality of it being four months until seeding and nine months from harvest.