The data prepared by the team at TEM points to confidence in the lamb market into 2022 and beyond. Where does StockCo see the opportunity? COO Tim Pryor says “It’s the one percenters that count. Our most successful clients who consistently deliver great trading margins are really focused on doing the little things right – drench frequently and move to a fresh paddock, treat for fly or lice before you see the signs, know how much you have and the quality of your feed – get nutritional advice, vaccinate proactively for things like pulpy kidney. The market is out of our control, but best practise management is without doubt the common thread we observe when paying out strong trading margins to our clients”.

Author – Matt Dalgleish, Thomas Elder Markets

The Snapshot

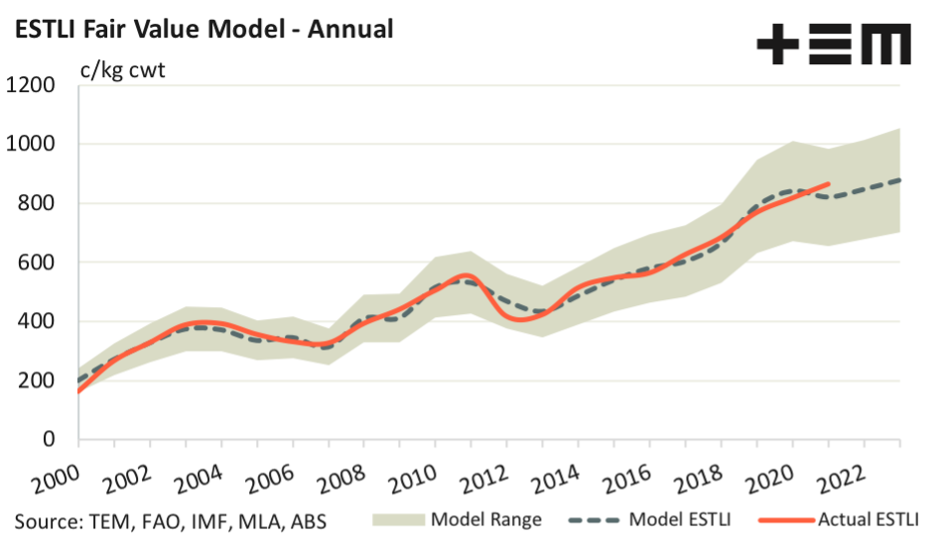

- The TEM ESTLI fair value model is currently predicting an annual average of 846c/kg for 2022 and 877c/kg for the 2023 season.

- It is not uncommon to see variance in price between 15-20% above and below the annual average price during the year for the ESTLI, suggesting that we could see a winter peak above 1000c/kg cwt and a seasonal low towards 700c/kg cwt in 2022.

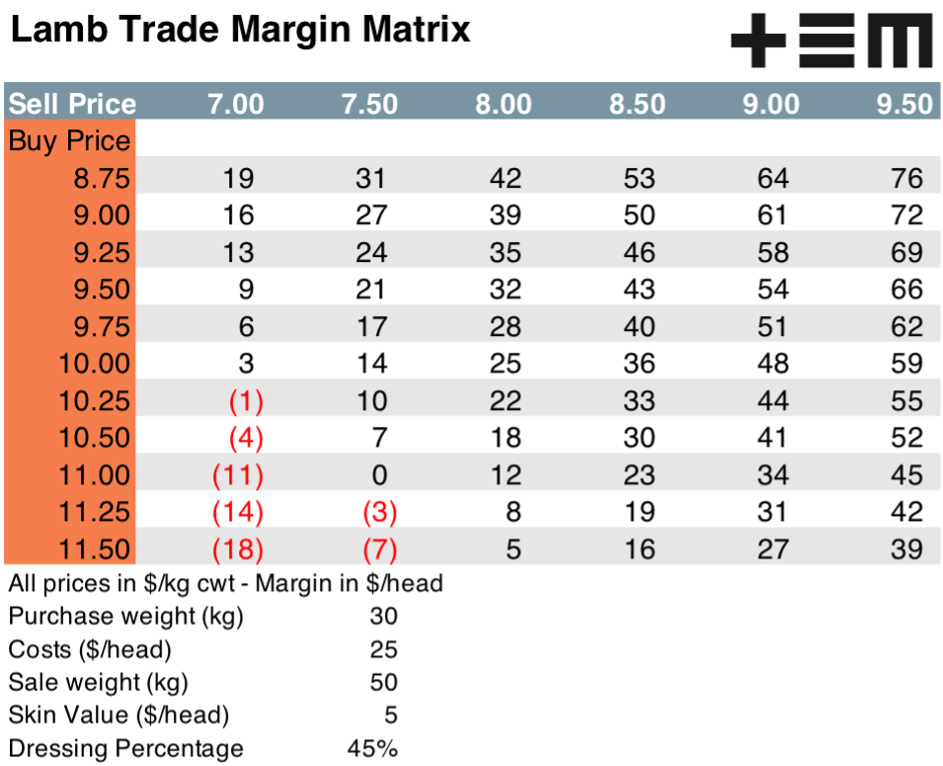

- A trade matrix demonstrates that under these forecast conditions there is money to be made buying restocker lambs at current prices.

The Detail

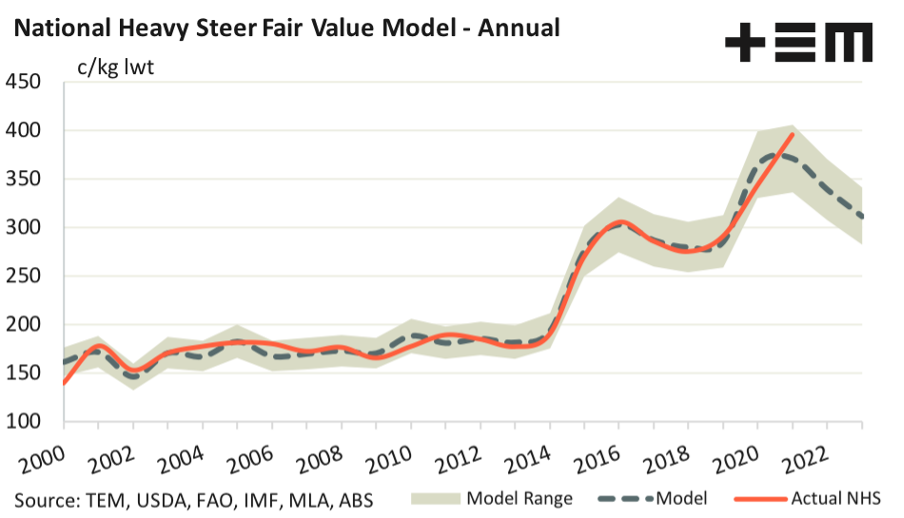

Updated forecast modelling of the Eastern States Trade Lamb Indicator (ESTLI) points to successive seasons ahead of relatively strong lamb pricing. The Thomas Elder Markets (TEM) fair value model for the ESTLI takes into account demand and supply factors that have historically been a key influence on the value of trade lambs in the eastern states and provides an annual average fair value price forecast to 2023, based on these supply and demand metrics.

The model suggested an annual average value for the ESTLI of 820c/kg cwt for the 2021 season. The actual annual average for the ESTLI this season has been 863c/kg, as at early December so we have slightly undercooked it. However, moving into the next few seasons the forecasted annual price of the ESTLI is showing strength.

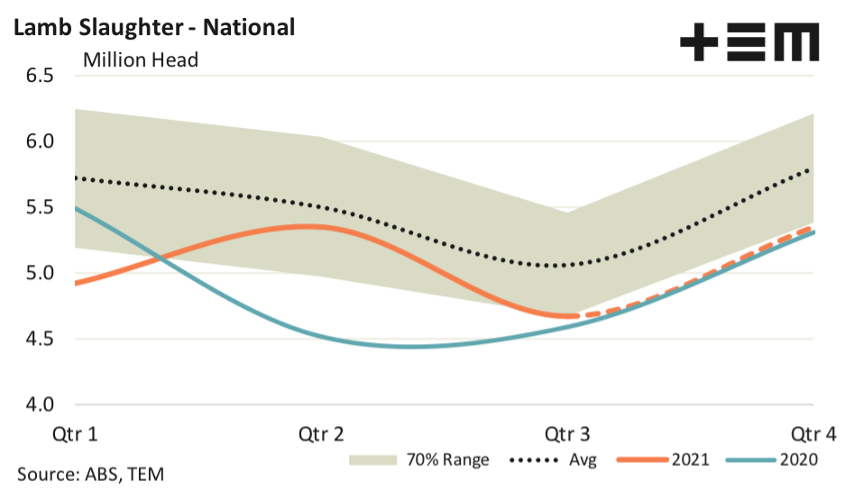

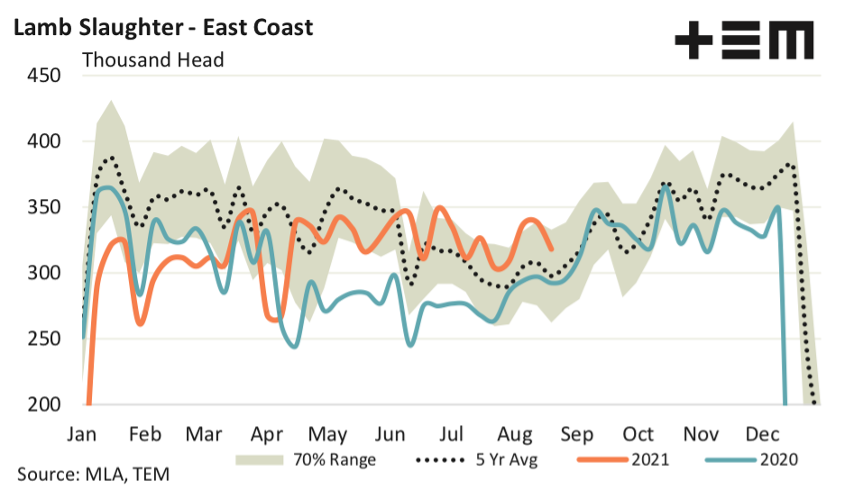

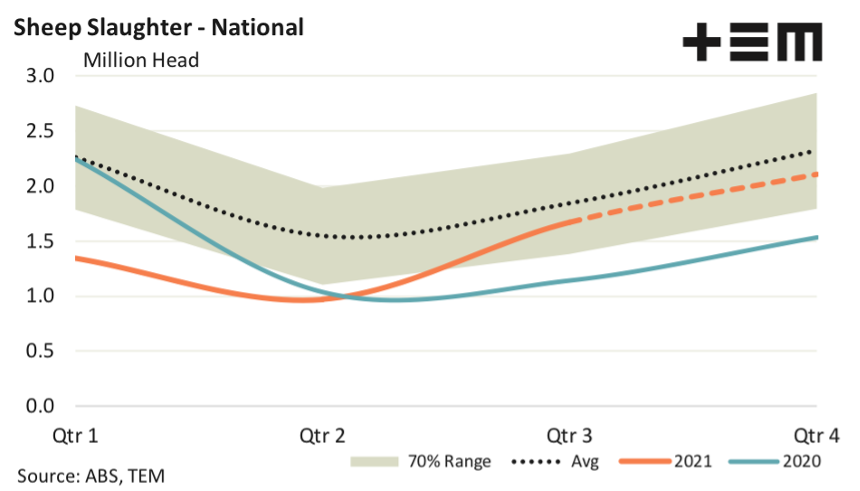

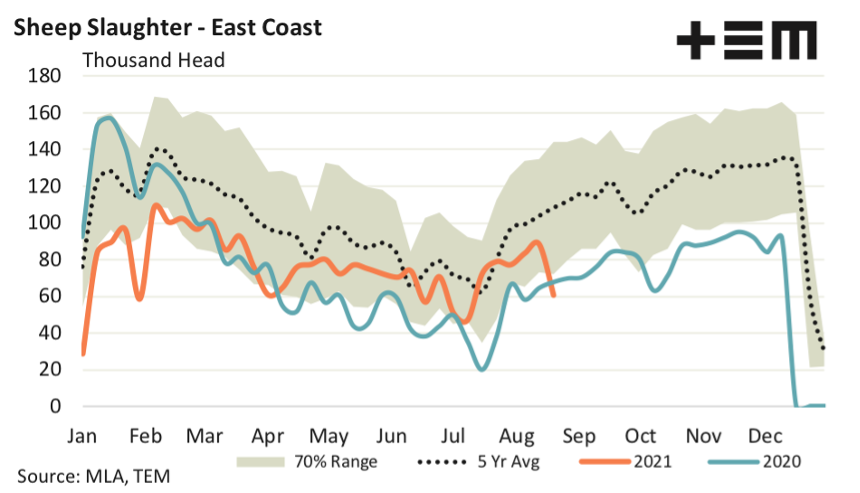

Meat and Livestock Australia are expecting increased lamb slaughter volumes as the flock rebuilds over the next few years, usually this acts as a dampener on prices, but strong sheepmeat export prospects, a recovering global economy post Covid-19 and an Australian dollar that is trending lower is working to support the price of trade lambs into the 2022 and 2023 seasons. Indeed, the TEM ESTLI fair value model is currently predicting an annual average of 846c/kg for 2022 and 877c/kg for the 2023 season.

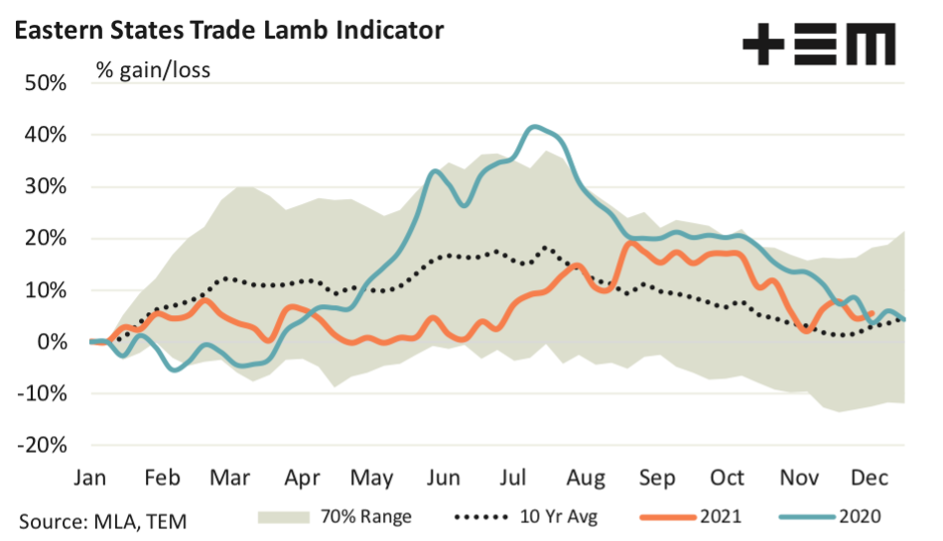

Historic ESTLI percentage price gain/loss patterns within the season demonstrate that price peaks are common during winter and the spring flush of new season lambs often corresponds with a seasonal low ebb to market pricing.

On average, it is not uncommon to see variance in price between 15-20% above and below the annual average price during the year for the ESTLI. This would suggest that on a forecast annual average of 846c/kg next year in the ESTLI we could see a winter peak above 1000c/kg cwt and a seasonal low towards 700c/kg cwt. Higher annual pricing in the ESTLI for 2023 could even see the seasonal peak heading towards 1050c/kg cwt.

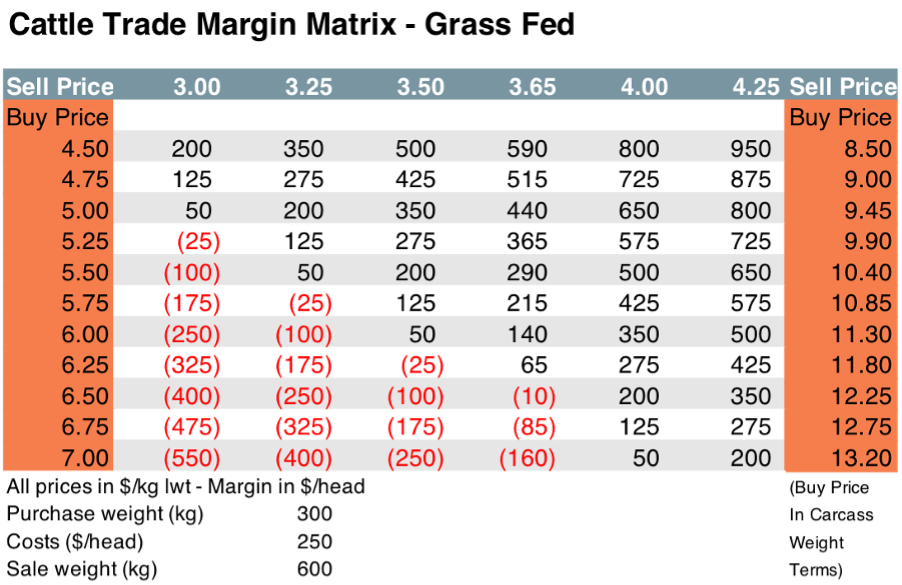

Back of the envelope analysis of a simple lamb trading scenario highlights some good opportunities for the lamb producer into the next few years. Assuming the following trade situation:

- Buy 30 kg liveweight restocker lamb

- Carry to 50kg liveweight heavy lamb and sell

- Skin value of $5 and dressing percentage of 45%

- Allowance of $25 per head costs for items such as transport, shearing, animal welfare and finance if applicable (Note – different enterprises will have different cost structures, your own per head costs can be added/deducted from the final margin if they are lower or higher than the $25 allowance)

Last week 30kg restocker lambs at saleyards in Victoria and NSW were fetching prices close to the 1000 c/kg cwt mark. Based on a 1000c/kg buy price and an estimated sale price nearer the ESTLI fair value model average of approximately 850c/kg cwt would net a per head profit, based on the trading assumptions, of $36.

As the matrix highlights, picking up cheaper restocker lambs and/or selling for a higher value could net as high as $50-$70 per head. On the other hand, selling toward the lower end of the forecast range for 2022 still manages to eke out a profit, albeit marginal at around $5-15 per head.