Is it a record? Maybe yes, maybe no.

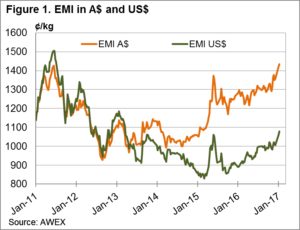

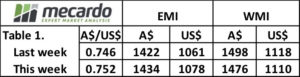

The first week of sales for the new year last week

opened with a bang, the EMI smashed through

1400 cents, while the WMI reached almost 1500

cents. (WMI has little influence from X Bred prices).

This week the good times continued, prompting

AWI to announce the wool market was at an

all-time record. This statement needs a little more

detail to confirm; the wool market across the board

is not all at record levels.

While not wanting to dampen down the enthusiasm,

the wool market covers a wide range of types, not all

are trading at highs. It also needs to consider the

timeframe; the high this week of the EMI still hasn’t

overtaken the April 1988 high of 1523. As Mecardo

followers will know, we also look at the price the

processors are paying to determine how strong is

demand; so, when looking at prices do you consider

the price from the buyer’s perspective or the seller’s

perspective? We think that while the price the grower

receives is important from an Australian viewpoint,

the cost to the buyers is a truer reflection of demand.

In Au$ terms the June/July period of 2011 was the

previous recent high for the EMI – 1426 cents.

At this time the A$ was trading at US$1.07, causing

the processors to shell out US$ 1500 cents. Note

that this week the EMI in US$ terms is still below

1100 cents. (Fig 1.)

The positives to the above analysis is that in this

scenario everyone is happy. Buyers receive regular

orders when the market is rising; processors don’t

want to miss out and a strong market resonates

confidence all the way up the wool pipeline. The

lower A$ (compared to peak levels when it traded

around parity) is keeping prices for the ultimate

end customers below previous peaks. Happy sellers,

happy buyers – the true definition of a “win-win!”.

On a cautionary note, the EMI high reached in the

winter of 2011 was then followed by the recent history

low point of 946 in September 2012. The market then

wobbled along with the EMI oscillating between

1000 + 1140 until early 2015 before the beginning of

this current positive run. Out take on this rear view is

that markets are continuously moving; so at “record”

levels locking in some of the future clip needs to be

considered. As one grower said, this is the time to

“kick the can as far down the road as we can!”

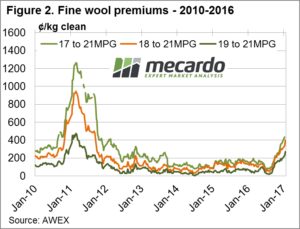

The trend of improving fine wool premiums continued

this week, we are now seeing the highest “basis” levels

since January 2012, however as Fig 2 shows, we have a

long way to run to get back to the heady days of 2011.

It is great to see that the 18 – 21 MPG basis has doubled

to 400 cents since October last year, fine wool producers

should begin to feel that their product is again on the up.

A challenge for the industry if, as is expected, the market

remains strong but supply stays static, is that the wool

trade may become frustrated that higher prices are not

encouraging increased production. As Andrew Woods

reported, sheep numbers in these bumper times are

only forecast to rise by 1.4% next year.

The Week Ahead

The offering of next week is below 50,000 bales so after a

couple of big offerings supply is easing, and based on reports

from traders the market is going to continue to remain active.

It would be unusual to see the market continue to rise at the

same rate as the last 2 week’s (not unprecedented though!),

so on balance a steady week ahead with a continuance of

strong demand for selected lots of the better-quality fine types.