How it Works

three easy steps

-

1

-

2

-

3

01

We work with you to assess the current

market value of your livestock...

then advance an agreed amount up to that figure – letting you

continue to maximise the price of your stock, rather than having to

sell when you need cash.

02

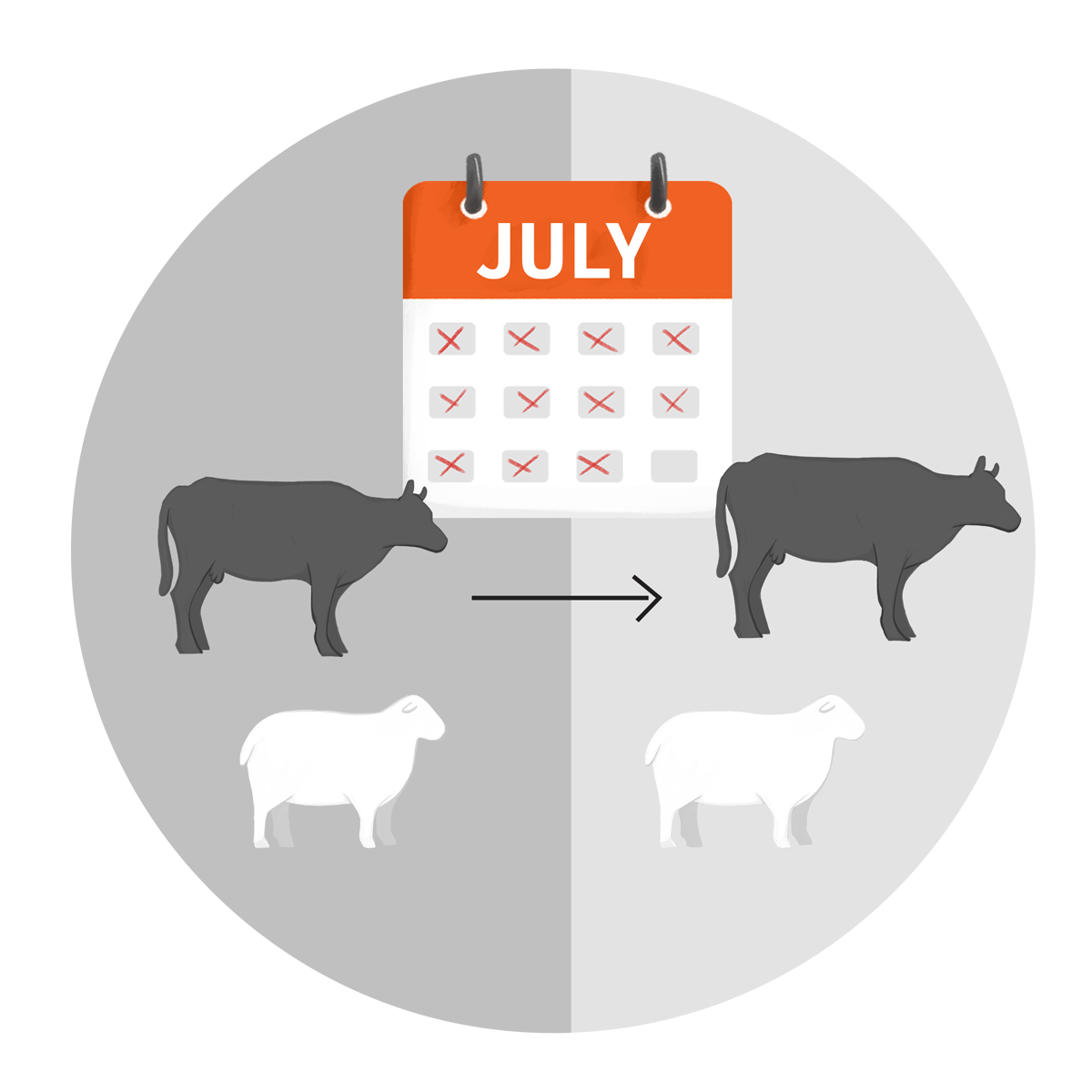

You background, finish or feedlot

your animals...

then sell when you choose, at the best possible time to

maximise your profits.

03

Once the livestock are sold, you receive the

sales margin...

with StockCo deducting the original Stock Advance, along

with the accrued finance costs.

Start maximising your profits today

apply nowCalculate what Stock Advance could do for you

Stock Advance lets you sell when the market conditions are right, rather than when you need an urgent cash injection. By holding on to your stock longer with a static market, you can create more weight, boost your sales and increase your margin – and our handy calculator can show you how it works.

Lambs

How your excess feed can help your livestock

If you have a great feed season, Stock Advance lets you use it for

your own bred lambs and boost your margins.

Day

0

-

Current weight kg

-

Avg. daily gain/day

-

DRS %

-

DRS weight

-

Price/kg/DRS

-

Finance cost *

-

Value

(Gross lamb value)

Day

20

Margin created

-

Current weight kg

-

Avg. daily gain/day

-

DRS %

-

DRS weight

-

Price/kg/DRS

-

Finance cost *

-

Value

(Gross lamb value)

Day

40

Margin created

-

Current weight kg

-

Avg. daily gain/day

-

DRS %

-

DRS weight

-

Price/kg/DRS

-

Finance cost *

-

Value

(Gross lamb value)

Day

60

Margin created

-

Current weight kg

-

Avg. daily gain/day

-

DRS %

-

DRS weight

-

Price/kg/DRS

-

Finance cost *

-

Value

(Gross lamb value)

*Disclaimer: Calculations are entirely driven by your enterprise and the outcome is not a responsibility of StockCo. Pricing varies depending on the Facility Limit required. For more information please contact StockCo.

Cattle

How your excess feed can help your livestock

If you have a great feed season, Stock Advance lets you use it for

your own bred weaners and boost your margins.

Day

0

-

Current weight kg

-

Avg. daily gain/day

-

Price/kg lwt

-

Finance cost *

-

Value

(Gross weaner value)

Day

0

Margin created

-

Current weight kg

-

Avg. daily gain/day

-

Price/kg lwt

-

Finance cost *

-

Value

(Gross weaner value)

Day

0

Margin created

-

Current weight kg

-

Avg. daily gain/day

-

Price/kg lwt

-

Finance cost *

-

Value

(Gross weaner value)

Day

0

Margin created

-

Current weight kg

-

Avg. daily gain/day

-

Price/kg lwt

-

Finance cost *

-

Value

(Gross weaner value)

*Disclaimer: Calculations are entirely driven by your enterprise and the outcome is not a responsibility of StockCo. Pricing varies depending on the Facility Limit required. For more information please contact StockCo.

Frequently asked questions about Stock Advance

StockCo purchases your livestock from you at an agreed value that is no greater than the current market value. When these livestock are sold, the proceeds are sent to StockCo. We retain the purchase price and finance costs and send you the difference

You need to have an active StockCo facility. Either one of our Livestock Managers (or your agent) will visit the farm to appraise your livestock. We need to make sure the stock are not captured by the security of another financier - for example, a bank or rural merchant. If they are, we will ask them to confirm that they have no security interest in the stock we are proposing to advance against. We can then purchase the stock from you and send you the funds. Levies are payable on this transaction. As the purchaser, we will pay you the GST-inclusive amount which will need to be remitted to the ATO.

If there are no other parties (banks, other financiers, rural merchants, etc.) interested in your livestock, we can complete the process in a matter of days.

The livestock agent’s appraisal will determine the market value of the livestock. We then consider the stock class, term of trade and expected margin. StockCo may advance up to 100% of the appraised market value of the livestock; however, the final amount may be reduced depending on your situation.

Generally, StockCo will accept the following forms of repayment:

- Sale proceeds of financed livestock (sent directly to StockCo from purchaser)

- Sale of progeny

- Sale of culls and empties

- Wool sales

- Cash

- Stock Advance against progeny or other stock*

* We recommend that where a customer indicates from the outset that they wish to complete a Stock Advance against the progeny to pay the principal, that they discuss this with their bank from the outset.

StockCo provides livestock finance facilities to customers that satisfy the following criteria:

- Existing livestock producer with greater than 3 years experience.

- Own existing livestock producing property, but can also have other leasing or agistment arrangements.

- Previous experience dealing in the proposed livestock class the customer is seeking finance for.

StockCo makes decisions based on its own internal credit criteria that may include, but isn’t limited to the above criteria. See the ready to trade with StockCo page for further information on the application process.

We take security directly over the livestock that we have funded. We register our interest in the livestock on the Personal Property Security Register. We also track livestock movements via the National Livestock Identification System Database. Additionally, in the event that our customer is not the owner of the business assets, we may require a guarantee.

In some instances, StockCo may require other security agreements following its assessment of the customer.

For Breeder Finance and Stock Advance products StockCo require a release from any parties that have an existing security interest that encompasses livestock. This release relates only to the livestock to be financed by StockCo. This process can take some time depending on the security interest holders' processes. See our Personal Property Security Register page for more information on security interests.

Our Buying and Selling Instructions are contained in the document section of this website

You can pay out your obligations to StockCo at any time with no penalties, however all trades have a maximum term of up to a year where livestock need to be sold by. This may be extended subject to StockCo's consent.

You can apply by completing our online application form or download a form from our documents page.

You can lodge your application with any of our approved distribution partners or directly with StockCo. To find a local distribution partner near you please contact us on 1800 283 447 or via email at [email protected].

In most cases we will visit you on farm to ensure we have a thorough understanding of your business and your goals.

After your application is lodged it will go through our Ready to Trade process.