How StockCo can help your business

As livestock finance specialists, we’re 100% committed to helping you make the most of every opportunity

Solutions for every livestock operation

Everything you need to grow your business

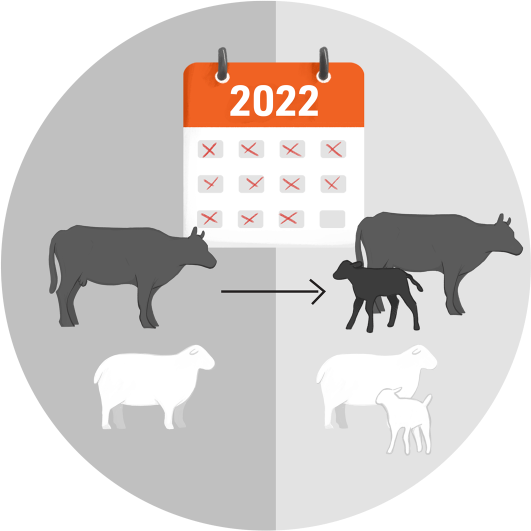

Breeder

finance

Expand your breeder operations

and maximise your profits

trading

finance

Exponentially grow your

business with no capital outlay

Stock

advance

Free up cashflow by releasing

equity from your livestock

Find out

more

Check your eligibility

Find out if you qualify for

livestock finance.

Answer three quick questions to get an instant answer.

Calculate your livestock margins

Estimate your potential gross profit.

Enter your purchase details and terms and work out your potential sale proceeds.

Create more weight with Stock Advance

Unlock the current value

of your livestock.

Get an instant value estimate, access the funds you need and sell when the time is right.

See Customer

Trades in

Action

Watch how successful trades

happen using StockCo's

livestock finance

- Trading finance - Cattle - SA

- Breeder finance - Cattle - NSW

- Breeder finance - Cattle - NSW

Frequently asked questions about StockCo livestock finance

StockCo provides livestock finance facilities to customers that satisfy the following criteria:

- Existing livestock producer with greater than 3 years experience.

- Own existing livestock producing property, but can also have other leasing or agistment arrangements.

- Previous experience dealing in the proposed livestock class the customer is seeking finance for.

StockCo makes decisions based on its own internal credit criteria that may include, but isn’t limited to the above criteria. See the ready to trade with StockCo page for further information on the application process.

StockCo evaluates each application and apply a finance rate that reflects the underlying strength of your application. Call us to discuss our market competitive rates.

You can apply by completing our online application form or download a form from our documents page.

You can lodge your application with any of our approved distribution partners or directly with StockCo. To find a local distribution partner near you please contact us on 1800 283 447 or via email at [email protected].

In most cases we will visit you on farm to ensure we have a thorough understanding of your business and your goals.

After your application is lodged it will go through our Ready to Trade process.

Generally StockCo will provide a decision on applications within 2 business days of receipt of all necessary information.

We have a preferred minimum limit of $100,000, although we will consider applications for smaller amounts where there are reasonable prospects to grow over time.

There is no maximum facility limit. StockCo has engaged in a number of transactions greater than $10 million.

No. The only cost to you is our finance rate, which is calculated daily and compounded monthly on your drawn balance only. You only pay for what you use, and the finance component is accrued along the way and collected by StockCo when you sell, so you can maintain steady cash flow throughout your trade.

We take security directly over the livestock that we have funded. We register our interest in the livestock on the Personal Property Security Register. We also track livestock movements via the National Livestock Identification System Database. Additionally, in the event that our customer is not the owner of the business assets, we may require a guarantee.

In some instances, StockCo may require other security agreements following its assessment of the customer.

Our strategy is to enhance your relationship with your existing bank, by providing an opportunity for you to generate greater returns from your existing livestock business, without impacting your existing arrangements with your bank.

We do this by taking direct security over the livestock we fund and by taking guarantees from major asset owning people or entities.

Our Buying and Selling Instructions are contained in the document section of this website