Reality check has timely lessons

Last week we had wool at all-time highs, and the

usual response is to look forward to see how much

higher it could go. This week the wool market provided

a reality check, prices on the opening day (Tuesday)

were down 20 to 40 cents compared to the close of last week.

It was the mid-point of Merino microns that suffered,

with 19 to 21 MPG feeling the brunt of the retracement

while fine wool was least effected.

The good news was that after the “correction” on

Tuesday, the market was remarkably resilient on

Wednesday; in fact, by the end of the week the 17 & 18

MPG’S had closed above last week’s level in Melbourne.

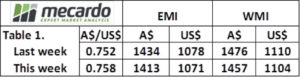

To retain some perspective; the EMI is still well above

the closing December markets, whether measured in A$

or US$ terms – figure 1.

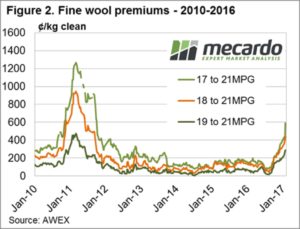

The trend of improving fine wool premiums continued

this week; the 18 Basis premium over 21 MPG has

doubled since October last year. Fine wool producers

have seen this premium rally from 123 cents this time

last year to now sit at 443. This will provide an incentive

to hold the line with fine wool sheep, although it is

concerning processors how far the micron will broaden

this year given the excellent seasonal conditions currently in play.

Growers response to the easing wool market was to pass-in 13.3% of the offering, or almost 6,000 bales. To break this down a bit more, of the 30,657 bales of Merino fleece and skirtings offered, 3,500 bales or 11.4% were passed-in by brokers. Normally this would be seen

as a “brave” decision when the market is at record levels; the change in supply as well as the very limited wool either in the pipeline or in brokers stores makes this decision a little more understandable.

As we said last week, high prices provide an opportunity in

the wool market to forward sell, this week’s retracement

is a timely reminder that often high prices are the

antidote for high prices.

This week we have had a lot of feedback about our blog

article, “Let’s make merino great again!”. We are looking

for innovations and ideas we can publicise to showcase the

great things that are happening in the merino/wool industry.

The Week Ahead

The offering of next week is 42,584 bales in all three centres

over two days. Based on the recovery to the Tuesday correction

and the reduced offering we should see the market at least hold.

The test will be if the processors remain buoyant about the

market outlook or were they “spooked” by this week’s roller

coaster and decide to sit back and see how this plays out.

As usual, interesting times for wool.