Tight supply maintains the strong prices

Meat and Livestock Australia (MLA) slaughter figures

confirmed that January lamb supply has been tighter

than usual. The result has been very strong summer

lamb prices, at a time when the market has tracked

sideways in recent years.

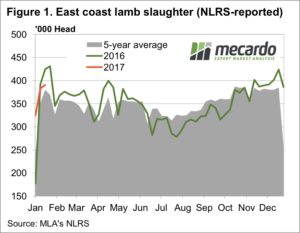

Figure 1 shows east coast lamb slaughter for the week

ending the 20th of January was well below last year.

The 18% reduction in numbers seems to have been due

to the good spring, which saw many lambs finish early

and hit the market in December, leaving a dearth of

numbers in January.

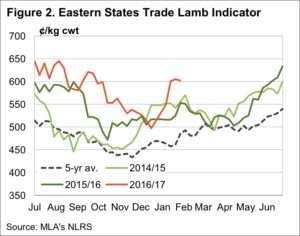

The result has been the best January lamb prices since

2011, with the Eastern States Trade Lamb Indicator

(ESTLI) managing to spend its third week above 600¢.

The ESTLI did ease slightly this week, but only 2¢ to

finish at 602¢/kg cwt. Mutton values took more of a hit,

losing 12¢ to hit 395¢/kg cwt as supply improved.

The question now for lamb markets is whether they can

maintain the strong levels. The five year average would

suggest they can, but figure 2 shows that in the last two

years February has seen the ESTLI ease. Lower prices in

February are likely due to domestic demand waning after

Australia Day and supply improving as shorn lambs start

to come back to the market.

As always the price trend will depend on how many lambs

are actually out there, and as indicated by survey results,

it could be fewer this year, so lamb prices could find some

solid support in the 560-580¢/kg cwt range.

The Week Ahead

We expect prices to ease over the coming weeks, but not

by much. Lamb producers not likely to be forced to sell in

the short terms, so may hold out for stronger prices if we

see any correction.

Mutton values should recover from this week’s correction,

it’s hard to see more supply coming forward given the feed

situation and the wool price.