Cattle projections forecasting lower slaughter but demand will drive prices

Meat and Livestock Australia (MLA) have hit the target

with their recent cattle projections, and as such not much

has changed in their January update. It is, however,

worthwhile taking a look at what the peak body see is

going to be the supply situation for the coming year

and beyond.

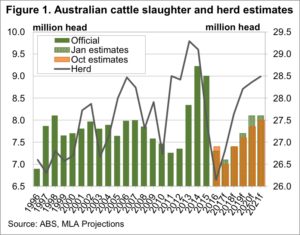

Figure 1 shows MLA’s slaughter and herd projections,

and how slaughter has changed from the October

estimates. The herd is still expected to have bottomed

out last year, at 26.14 million head, a 20 year low.

A relatively quick herd rebuild is expected, on the

back of 20 year low slaughter rates next year. The herd

isn’t expected to reach the highs of 2013 in the next five years,

but is expected to move back above 28 million head by 2019.

MLA have made some slight revisions to slaughter

numbers. For 2016 slaughter was down 100,000 head,

and this has been shifted into 2017, lifting the estimate

by 1.4% to 7.1 million head. Further down the track

slaughter estimates have been lifted marginally,

basically due to the herd being slightly larger than previously estimated.

The projections of 8 million head slaughtered in 2020

and 2021 are high relative to historical levels, but remain

well behind the peaks of 2014 and 2015. Obviously MLA’s projections are based on ‘normal’ seasonal conditions, with the growth in the herd driven by current strong prices, and the fact many regions are currently understocked.

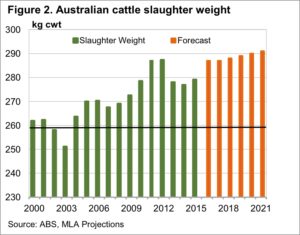

Some interesting figures from this week’s projections

comes from the average carcase weights of cattle

slaughtered. Figure 2 shows a jump in slaughter weights

in 2016, from the lows of the drought where heavy female

young cattle slaughter saw weights at 278-279kgs. In 2016

slaughter weights increased 3% to 287kgs per head, and

are expected to start a slow ascent to 291kgs by 2021.

Interestingly the 2016 slaughter weights couldn’t quite

eclipse those seen in 2012, which suggests that the good

season wasn’t enough to see cattle held to heavier weights.

Rather producers took the good money when cattle

were ready.

Key points:

- MLA have released their updated cattle projections,

with little change to herd or slaughter forecasts. - The cattle herd is expected to have bottomed out in 2016,

with the slaughter low coming this year. - Continued tight cattle supply should ensure prices

remain relatively strong for the coming year.

What does this mean?

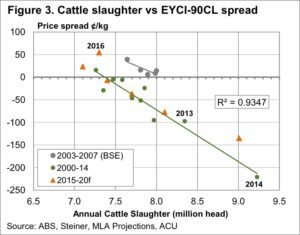

Regular readers will be familiar with figure 3, which plots

the spread between the 90CL export price and the EYCI,

against annual cattle slaughter. The fact that the 2016

point sits well above the trend suggests local demand

was very strong in 2016.

As that restocker demand wanes as the herd grows we

would expect the EYCI’s premium over the 90CL to fall

back to the trend line. This means that even though slaughter

is expected to be lower this year, we may see lower prices as

well, with the current 90CL price, and the historical trend

suggesting the EYCI should average around 600¢ in 2017.