The market giveth, and the market taketh, then gives back again!

The exciting wool market experienced over the past 6 months has now become a confused beast. Despite reports of a lack of supply across the wool pipeline, from farm woolsheds to processor mills, the market again spent the week in reverse. Interestingly, on Thursday the market shifted gears and rebounded to finish strongly.

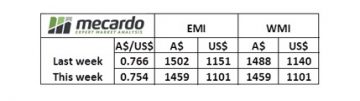

The EMI closed down 43 cents in A$ terms at 1449¢ and also softer in US$ terms at 1101¢, down 50¢. In Fremantle, the later selling time and strong finish to the week resulted in an indicator less effected with a 29¢ decline in A$. terms for the week – Fig 1.

The EMI closed down 43 cents in A$ terms at 1449¢ and also softer in US$ terms at 1101¢, down 50¢. In Fremantle, the later selling time and strong finish to the week resulted in an indicator less effected with a 29¢ decline in A$. terms for the week – Fig 1.

It was almost a tale of two sales for this week, on Wednesday the EMI & WMI lost 45 & 48 cents respectively, 18 MPG fell 96 cents and 21 MPG in Melbourne was off 55 cents -Fig 2.

The reversal on Thursday saw the EMI gain 2 cents, however the WMI finished plus 19 cents for the day with reports of a strong finish to the market. Gains were across the Merino combing section, 18 MPG plus 16 and 21 plus 19 cents in Melbourne.

The reversal on Thursday saw the EMI gain 2 cents, however the WMI finished plus 19 cents for the day with reports of a strong finish to the market. Gains were across the Merino combing section, 18 MPG plus 16 and 21 plus 19 cents in Melbourne.

Fremantle was stronger with 18.5 MPG finishing up 22 cents and 21 up by 31 cents.

Fremantle provided good entertainment, on Wednesday 33% of fleece lines offered were passed in, and withdrawals for the Thursday sale were significant.

It seems that the falls on Wednesday encouraged exporters to book business and when they returned on Thursday to a reduced offering we saw the resultant rally. This caused the pass-in rate to fall compared to Wednesday, in Fremantle for example the first day a total of 29% was passed-in, however the next day this rate fell to 11.4%. Also impacting was the withdrawal of 20% in reaction to the price falls of the previous day.

It seems that the falls on Wednesday encouraged exporters to book business and when they returned on Thursday to a reduced offering we saw the resultant rally. This caused the pass-in rate to fall compared to Wednesday, in Fremantle for example the first day a total of 29% was passed-in, however the next day this rate fell to 11.4%. Also impacting was the withdrawal of 20% in reaction to the price falls of the previous day.

The week ahead

This has been the second week of a dramatic wool market correction, coming at a time of tight stock positions across the wool pipeline. That said, it was noted by one buyer that for the past month wool offerings have been increasing, so perhaps this was a test by processors to check the market.

Wool producers are not in any hurry to sell wool if the market retraces like this week, and conversely, they have been keen to sell wool as the market rallied.

Wool producers are not in any hurry to sell wool if the market retraces like this week, and conversely, they have been keen to sell wool as the market rallied.

While its risky making statements about the market level in the future, the fundamentals haven’t changed despite the market volatility of the past 2 weeks. Supply is tight and mills need to purchase.

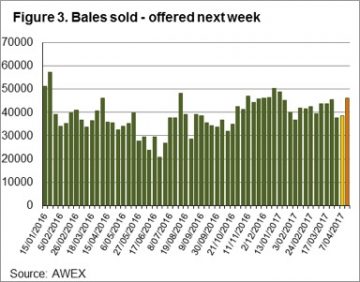

Next week we have a reduced offering of 46,200 bales listed for sale with trading scheduled over two days.