Lengthening days trigger weaker restocker demand

In general lamb prices were largely steady this week, but trends were mixed depending on category and state. With supply remaining relatively strong as we pass the winter solstice, and new season lamb supply fast approaching, the question is whether we have seen the peak.

In general lamb prices were largely steady this week, but trends were mixed depending on category and state. With supply remaining relatively strong as we pass the winter solstice, and new season lamb supply fast approaching, the question is whether we have seen the peak.

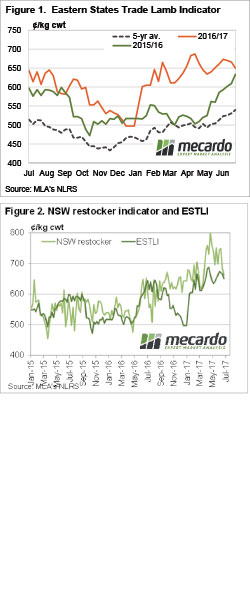

After spending the best part of six months tracking well above last year’s prices, the Eastern States Trade Lamb Indicator (ESTLI) this week eased back to within 17¢ of the late June-16 value, at 650¢/kg cwt (figure 1).

We are yet to get hold of any supply figures for the last week, but anecdotally are hearing that there are plenty of heavy trade, and heavy lambs hitting the market at the moment. This is at a time when some major processors are winding down for winter shutdowns, thereby reducing demand.

Light and Merino lambs also fell this week, losing 16 and 25¢ respectively on the east coast. But it was Restocker lambs which were the major movers, falling 54¢ to 661¢/kg cwt. Figure 2 shows this is the cheapest restocker lambs have been since February.

It’s not unusual for restocker demand to ease at this time of year, as any lambs purchased could have to be marketed against new season lambs, and price declines can get ugly in the spring.

Mutton markets eased in line with trade lambs, losing 17¢ to move back to 504¢/kg cwt. Still a good price, and just 22¢ off the peak.

the week ahead

There shouldn’t be many old season lambs left out there, but they seem to keep coming. With only about six weeks until new season suckers come to the market, time is running out for the ESTLI to have a crack at 700¢. Forward contracts are still available for trade and heavy lambs at around 660¢ for August, so there is some concern around supply at that time of year. Given the price resistance being found at 700¢, it’s hard to see prices being much higher than this come August.