Down in the east tanking in the west

The Eastern Young Cattle Indicator (EYCI) fell for the sixth straight week, and took most other indicators with it. In the West prices tanked, but it might be an outlier. The story remains the same, with dry weather and relatively high prices encouraging offloading of stock.

The Eastern Young Cattle Indicator (EYCI) fell for the sixth straight week, and took most other indicators with it. In the West prices tanked, but it might be an outlier. The story remains the same, with dry weather and relatively high prices encouraging offloading of stock.

Even the 90CL Frozen Cow Indicator got in on the falls this week, it tanked, losing 18¢, or nearly 3%, to 641¢/kg swt. Increased slaughter here is reportedly starting to impact supply, on the positive side, here.

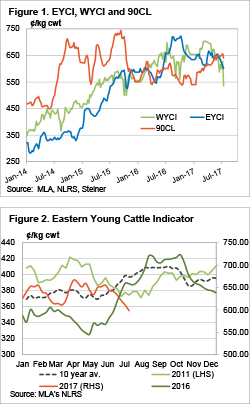

Figure 1 shows that while the 90CL was lower, it’s still well above the EYCI, and this is one of the measures we use to judge cattle value. For the first time in nearly two years the EYCI seems undervalued.

Most other cattle categories drifted lower this week, to the tune of 10-20¢/kg cwt. The exceptions were cows, which managed to gain 5-10¢ in Queensland and Victoria.

Higher grain prices looking to be starting to bite feedlots. While still historically very strong, feeder prices this week fell 5-15¢ to range from 318¢ for Domestic feeder heifers, to 363¢/kg lwt for long-fed export steers. With grain prices now around $100/t higher than harvest, feedlots are obviously going to try and either increase grainfed cattle prices, or decrease feeders.

We suspect it may have been on small numbers, but the Western Young Cattle Indicator (WYCI) fell heavily this week, losing a massive 91¢ to hit a 22 month low of 536¢/kg cwt. Given that over the hooks quotes for yearlings in WA remain in the 580 (Grassfed)-630¢ (MSA) range we’d expect to see a bounce in the WYCI.

The week ahead

The movement in the EYCI this year is really like no other year. It is almost a mirror image of 2016, and cattle producers will be hoping this doesn’t continue. If it does we’ll be headed for sub 550¢ levels. It takes a very short memory if you think 550¢ isn’t an acceptable price. A good general rain will fix the ‘low’ price problem, there just isn’t one on the horizon.