Market influences

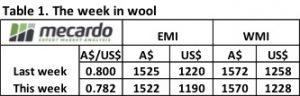

An overall satisfactory wool sale result this week, however we need to acknowledge that the weaker A$ played a part. Last week the A$ touched out at US$0.80, whereas this week it closed at US$0.782. Causes for currency moves are varied and debatable, and we can’t be sure if the weakness in the A$ is anticipating a Tigers/Crows win or loss in the AFL; or perhaps it is due to the struggle NSW NRL fans are having coming to terms with a Cowboys/Storm final?

An overall satisfactory wool sale result this week, however we need to acknowledge that the weaker A$ played a part. Last week the A$ touched out at US$0.80, whereas this week it closed at US$0.782. Causes for currency moves are varied and debatable, and we can’t be sure if the weakness in the A$ is anticipating a Tigers/Crows win or loss in the AFL; or perhaps it is due to the struggle NSW NRL fans are having coming to terms with a Cowboys/Storm final?

The Eastern Market Indicator for the week slipped 3 cents to close at 1,522 cents in A$ terms, while in US$ terms it fell 30 cents to 1,190. The market in the west moved only marginally also, losing 2 cents to close at 1570 cents.

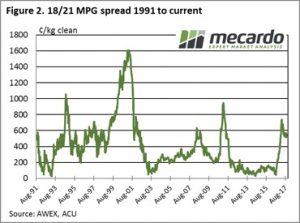

A key point of interest in the wool market is the fine wool price, including the fine wool price relative to medium wool.

A key point of interest in the wool market is the fine wool price, including the fine wool price relative to medium wool.

Currently, the 18 MPG is sitting comfortably above the 2,000-cent mark, and the 21 MPG is above 1500 cents at 1524. In fact, the 18 MPG is settled closer to 2,100 (currently 2,078 in Melbourne) having briefly bobbed above 2,200 earlier this year while the 21 MPG poked its nose above 1,600 last month.

For the 18 MPG, this rally first broached 2,000 cents in March this year, while the 21 MPG found the 1,500-cent benchmark earlier in July last year.

It has been a long wait for the 18 MPG since the last 2,000 cent level was touched; we need to go back to June of 2011 which marked the beginning of a long period of sub-2,000 cent 18 MPG indicator levels.

On the other hand, while the 21 MPG also had a good period in 2011, it managed to first break the 1,500 cents level this rally in July last year.

Of course, this leads to comparisons of relative price levels. Figure 2 shows the basis or spread between the 18 & 21 MPG’s for the Southern selling region. Currently the 18 over 21 MPG premium is sitting nicely at 554, having briefly touched the high level of over 700 cents in March this year.

Of course, this leads to comparisons of relative price levels. Figure 2 shows the basis or spread between the 18 & 21 MPG’s for the Southern selling region. Currently the 18 over 21 MPG premium is sitting nicely at 554, having briefly touched the high level of over 700 cents in March this year.

It’s been a long wait though, while a 400-cent premium showed up in January this year, fine wool producers last received a greater than 400 cent premium over the 21 MPG in September 2011.

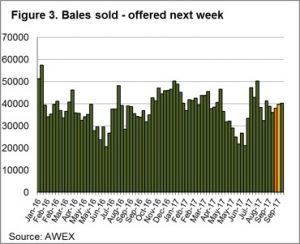

A total of 39,657 bales were cleared to the trade this week, with the pass-in rate of 8.2% only slightly higher than last week’s 6.9%. (Figure 3).

In regards to the Melbourne fine wool market performance, this was affected by an increasing prevalence of wool exhibiting higher mid breaks. To emphasise, AWEX report that wool with less than 20% mid breaks found increased competition and greater premiums.

The week ahead

A total of 40,587 bales are listed for sale next week across the three selling centres. This is consistent for the next three weeks roster with around 40,000 predicted each week to be offered.

The market looks remarkably stable at present, and providing we don’t see a sudden surge in the A$ this should translate into another good week to be selling (that is providing the footy community can cope with an all Victorian result!!!)

The market looks remarkably stable at present, and providing we don’t see a sudden surge in the A$ this should translate into another good week to be selling (that is providing the footy community can cope with an all Victorian result!!!)