A muted start, but don’t write it off – Tet!

- The live cattle trade flow to Indonesia remains under pressure due to high local prices and stiff Indian competition.

- Chinese live cattle volumes are showing signs of a resurgence, particularly in the last quarter of 2017.

- Vietnamese demand for Australian live cattle continues to remain robust.

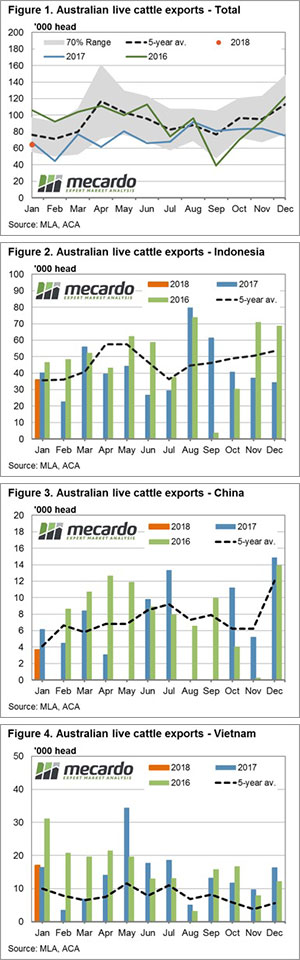

A comparison of historic seasonal monthly live cattle trade flows shows that it isnot uncommon to see January post the lowest cattle movements for the year. This is because the monsoon weather patterns generally make it more difficult to get cattle out of the northern ports. This January, total live cattle consignments have started the season in a similar fashion to 2017 – below the five-year January average by about 15%, but still within the normal range.

Figure 1 highlights the historic seasonal trend which shows that we are pretty much on par with last year with 64,400 head reportedly making their way offshore. Meat and Livestock Australia (MLA) report that a total of nearly 880,000 head of cattle left the country during 2017, some 20% below the average annual volume for the last five years.

The impact of tighter local supply and subsequent high prices having an effect on offshore demand, particularly in Indonesia – where competition from Indian buffalo meat continues to pressure the flow from Australia. Indeed, nine months of the 2017 season saw live cattle flows to Indonesia fall short of the comparable monthly seasonal average, based off the five-year historic data (Figure 2). The last quarter of 2017 was particularly soft with trade flows averaging 27% below the five-year trend and 34% under the comparable period during 2016.

Chinese flows appear to be becoming more frequent, after a somewhat sporadic season in 2017 with successive live trade reported for the last four months – figure 3. Indeed, 2017 was a bit patchy with no trade reported during May, August and September. However, Chinese demand finished 2017 strongly with average monthly flows of the last quarter of the season sitting 27% above the five-year final quarter average. January 2018 has started the season a little muted, sitting 10% below the five-year January average with nearly 3,700 head reported.

In contrast, live cattle flows to Vietnam have performed strong and steady, with nine months in the 2017 season posting volumes above the respective monthly long-term average pattern – figure 4. The second half of 2017 was particularly solid with average monthly flows over the period coming in 80% higher than the seasonal average trend. January 2018 consignments have shown a similarly robust start to the year with more than 17,000 head reported, a 70% gain on the five-year January average.

What does it mean?:

It’s not uncommon to see a strong start to the live slaughter cattle trade to Vietnam at the beginning of the year as the country gets prepared for the annual Tet New Year celebrations, usually held late January/early February.

However, the strong performance of Vietnamese demand for Australian live cattle throughout much of 2017 is a promising sign given that these flows account for around 15% of the total live cattle trade out of Australia, based off the five-year average market share.

The high local cattle prices appear to have had limited impact on Vietnamese flows over the 2016 and 2017 seasons. As local production increases and prices ease toward the end of the decade with the herd rebuild gaining momentum there is a good chance this will translate to greater Vietnamese demand in the coming years – particularly as their population grows in size and in average wealth.