Easter lull hits supply.

A short week due to the Easter break has taken its toll on cattle supply with yarding levels and slaughter reflecting the holiday break. Saleyards reported some higher steer prices on the back of the reduced supply, but most other cattle categories trekked sideways in the reduced trade environment.

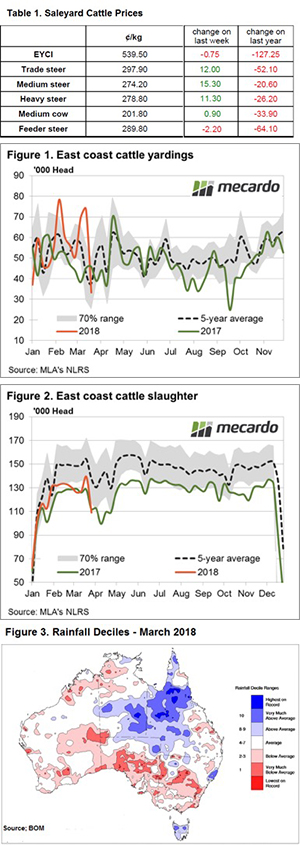

Table 1 outlines some price movements on the week for key categories of cattle at East coast sale yards. The benchmark EYCI was only marginally lower, closing at 539.50¢/kg cwt yesterday. Trade (298¢), Medium (274¢) and Heavy Steers (279¢) all managed 10-15¢ gains on live weight prices, while Feeder Steers lost a little ground off 2 ¢ to close at 289.8¢/kg lwt.

¢ to close at 289.8¢/kg lwt.

Figure 1 shows that East coast cattle throughput is back within the normal seasonal range, after posting elevated levels over the past fortnight and is now trending slightly below average at around 33,000 head. The recent volatility noted in East coast yarding levels have been mainly QLD centric with northern producers responding to monsoonal climate variability.

The East coast slaughter pattern is also reflecting the Easter inspired lull in activity and is demonstrating a similar pattern to yarding levels with a higher than 2017 pre-Easter slaughter now back under the 2017 levels this week. A 109,000-head cull was reported for the week ending 30th March – Figure 2.

In off shore markets, the 90CL frozen cow indicator continues to consolidate around 600¢/kg CIF and has been holding firm at this level for the last two months. The usual seasonal pattern for 90CL is for an increase in prices as we head toward the US grilling season with a few more burgers flipped onto the BBQ.

What does it mean/next week?’

The April Bureau of Meteorology forecast suggests average rainfall across the eastern seaboard for the month, although not much is anticipated to fall in the coming week in the South as a blocking high pressure system is keeping it clear and sunny.

Dry rainfall deciles for March across much of NSW and SA demonstrate just how some parts of the country are in need of the Autumn break and the dry conditions have been keeping prices subdued in some areas – Figure 3.

Prices are likely to keep in a consolidation phase in the coming week, with a slight downside bias as the delayed start to the break applies some pressure – all eyes are on the sky for some rainfall and some price support as we head towards Winter.