Asian appetite for mutton holds firm

- Total mutton trade volumes for April are sitting 21% above the five-year trend.

- Consignments to Asia are 76% above the April five-year seasonal average level, buoyed by Chinese demand which is running 96% higher than the five-year trend for the January to April period.

- Mutton price modelling shows that continued growth in Chinese middle-class wealth could negate the impact of increased slaughter in the coming years, keeping mutton prices firm.

Department of Agriculture and Water Resources (DAWR) trade statistics for April were recently released, revealing that the above average flow of mutton product leaving Australia persists. Analysis of the key trade destinations highlights that Asian demand continues to underpin the total mutton consignments. This piece reviews the impact on mutton prices over the next few years if the Asian demand continues to grow in line with an expanding Chinese middle class.

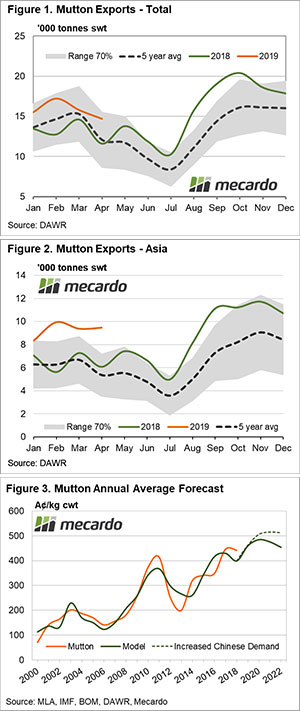

Total mutton exports for April recorded the lowest monthly volume for the current season at 14,675 tonnes swt, a 7% decline on the March figures. Despite the lower trend, mutton exports have remained above the five-year average seasonal pattern during 2019 and the April volumes are comfortably sitting 21% above the five-year average for April (Figure 1).

The 2019 trend for total mutton exports has spent the season in the upper end of the normal range, as identified by the 70% shaded zone. In contrast, mutton exports to Asia have started 2019 incredibly strongly, remaining above the normal range and around 50% higher than the five-year average monthly trend for the January to April period.

It is not uncommon to see Asian mutton demand begin to wane as we head into April. However, this season it has remained firm with 9,640 tonnes shipped, 76% above the five-year April average pattern (Figure 2). Chinese demand for mutton has been a key driver of the elevated Asian volumes. Average monthly flows of Australian mutton to China for the January to April period were 96% above the five-year trend.

An anticipated reduction in mutton slaughter levels to 7.2 million head in 2020 could see average annual mutton prices peaking around 485¢, before an increase in mutton slaughter during the 2021 and 2022 seasons pressures annual average mutton prices back down to the 450¢ region (Figure 3). However, growing Chinese demand for mutton could negate the impact of increased slaughter into the 2021 and 2022 seasons, pushing the annual average mutton price above 500¢.

What does it mean?

Mutton price forecast modelling undertaken by Mecardo highlights a link between the growth in Chinese wealth levels and the increasing consumption of mutton. Figure 3 also demonstrates the forecast price impact upon the Australian mutton price. It assumes an increase of Chinese per capita GDP from $US9,776 in 2018 to $US13,000 by 2022 and annual trade volumes of mutton from Australia to China growing by 25% over the 2019-2022 period.