Offshore support shores up price

The market is turning around, with overseas concerns starting to be a primary driver on our price (as opposed to drought). In this weeks market comment, we take a look at pricing/basis and the newly launched farm aid package for US farmers.

Since July last year our prices have largely been guided by events locally. The drought has pushed basis (premium/discount over Chicago) to levels unseen during the de-regulated marketing environment. This has meant that broadly prices have been strong, and that events overseas have been mostly inconsequential as drought bites. The story over May has largely changed.

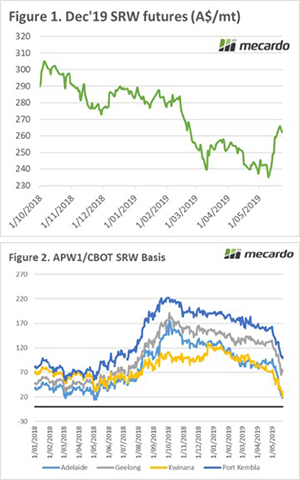

The futures market declined steadily from Mid-October through until the start of May. This was driven by positive prospects for the northern hemisphere crop. The speculators jumped in and became extremely short, driving the market further south.

The US however was hit by rainfall throughout recent weeks which has resulted in delays to the planting of the corn crop. As we are all aware there are relationships between agricultural commodities which has caused a flow on to wheat. In the month of May the December futures contract has risen A$23 (figure 1).

When we look locally at our basis (figure 2), we can see that it has fallen since harvest. The biggest falls have occurred in May when beneficial rainfall hit during the start of the month providing some early confidence to buyers. The increase in futures prices is welcome, and if we see continued dry weather in Australia, basis will likely rise further as buyers return to a state of nervousness.

In the United States, the newest installment of farm aid was launched. The farm aid package is designed to compensate farmers (who happen to be Trumps support base) for losses from the trade kerfuffle between China and the US.

It is not yet clear how the fund will be distributed, but it will be based on a county by county basis. This is in order to ensure that it doesn’t impact upon planting intentions, however there are concerns that it will still increase soybean acreage.

The following statement was made by the US President during a press conference:

“The farmers have been attacked by China, but the $16 billion of funds will make clear that no country has veto on America’s economic and national security” Donald Trump

What does it mean/next week?:

The update on planting progress in the US will be the primary driver of the market in the coming days. If we see corn planting remaining well below expectations, it wouldn’t be surprising to see another rise in levels.

The COT report will also provide an indication of the change in positioning of speculators. It is likely that their net short position will be reduced quite dramatically after recent rises.