The market giveth, and the market taketh

The concerns we expressed last week about the weak finish to sales in Fremantle came to fruition, with the Melbourne and Sydney markets quickly adjusting down on the opening day.

This proved a catalyst for a loss of confidence and the market tracked lower wiping out last week’s gains and then some.

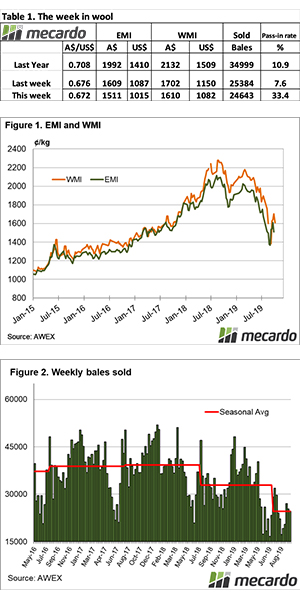

The Eastern Market Indicator (EMI) fell 97 cents or 6% (after lifting 67 cents or 4.2% last week), to close at 1,511 cents. The Au$ also eased fell slightly to US $0.672. This saw the EMI in US$ give up “only” 72 cents to end the week at 1,015 cents.

Western Australia had a tough selling week, selling just 4,300 out of 7,300 bales offered, (a PI rate of 40.8%) with the Western Market Indicator dropping by 92 cents to close at 1,610 cents.

Sellers reacted to the sharp sell-off with the National Pass-in (PI) rate increasing for the week to 33.4%, up by a massive 26% on last week. Again W.A. was a major influence, with almost 50% of fleece wool not selling, for a combined W.A. Pass-in rate of 40.8%.

An increased offering of 37,021 bales came forward, with 24,600 bales cleared to the trade (Figure 2). There have been 112,839 fewer bales sold this season compared to the same period last year. This is an average weekly gap of 10,258 bales.

The decline in Australian wool delivered to the world’s processors is alarming, looking at the same periods (July to current) for 2017, 2018 & this year we see 442k bales sold in 2017, followed by 383k last year & 270k this year to date. This is roughly a 40% decline over three years in bales sold to the trade. There is little doubt that demand for wool has suffered, with a myriad of possible reasons to explain this decline.

The dollar value for the week was $42.07 million, for a combined value so far this season of $466.88 million, and a bale average value $1,707.

Trying to find any shining lights this week is difficult, with the Cardings indicators up by an average of 4 cents, however, Crossbreds types were not spared and fell by 50 to 90 cents.

The week ahead

Next week a much-reduced offering of 34,174 bales are rostered.

AWEX notes that the volatile market has left “sellers uncertain”, I think it is fair to say the exporters are also feeling the concerns. The massive movements almost on a weekly basis are unprecedented; this will be making life difficult for exporters advising and negotiating buying orders.