Only one week in the doldrums for mutton

Before Christmas mutton prices took a dramatic downturn. The talk was Chinese demand suddenly evaporating. The New Year has seen mutton return to previous levels, while lamb has also found some strength.

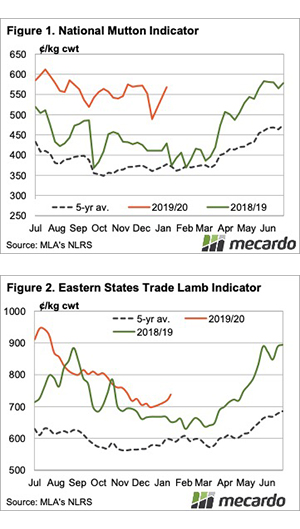

Figure 1 shows the bounce in mutton prices, the National Mutton Indicator closed 2019 at 489¢, and closed yesterday at 561¢/kg cwt. Holding sheep for the extra three or four weeks has definitely been worth it, with $15-20/head added to the price.

Lamb prices have also bounced off 8-month lows hit at the end of December. Figure 2 shows the Eastern States Trade Lamb Indicator (ESTLI) has gained 40¢ to start the year, moving to a nine-week high of 738¢/kg cwt.

While lamb prices are still behind some of the forward contracts on offer in the late spring, we can see from figure 1 they are well ahead of this time last year. It took until May in 2019 for the ESTLI to move above 740¢/kg cwt.

In WA lamb and mutton prices have opened lower in saleyards, both well behind the east coast. The WA Trade Lamb Indicator opened at 614¢/kg cwt, while the Mutton Indicator is at just 387¢. If the rain falling in NSW keeps coming WA mutton will have to rise, or sheep will start travelling east in droves.

Next Week

The fire may have seen a short term spike in sheep supply, as have the higher prices early in the year. We expected sheep supply to tighten anyway, but the wet weather on the forecast should see things tighten significantly. It will be interesting to see if prices do move higher, whether they will be able to draw out more sheep.

Lamb supplies are less predictable, but rain, and potential grass growth, can only see more lamb retained, and less destined for processors.