The grain must flow

Key Points

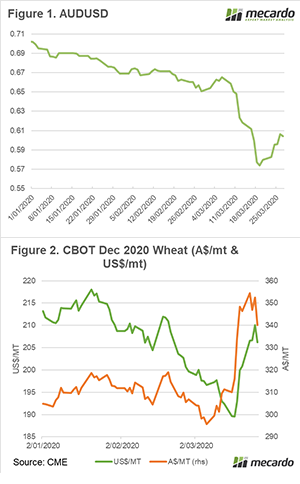

Last week the Australian dollar was the major discussion point. The dollar floated like a lead balloon to lows of 55¢, the lowest level since 2001. This meant that our local pricing and Swaps increased dramatically. As much as last weeks fall was impressive, this week the rise has been equally dramatic.

At the time of writing this, the Australian dollar has increased to 60¢ (figure 1). During any other period, this would be considered an unusually strong move, but in the current environment large swings are to be expected.

In the previous weeks, wheat futures had actually been declining but the A$ was providing most of the benefit to local pricing. In this past week however, we have seen futures start to rise, which has somewhat outweighed the rising A$ (figure 2).

The reason for the rally was two fold. The panic buying seen around the world for staples such as pasta has resulted in an increase in demand from flour mills. This can be seen in the market preference for nearby contracts as opposed to further down the horizon. This has led to the forward curve moving from contango to a flat/backward structure.

The other major reason was anxiety related to the supply chain. There is a concern that a major exporter such as Russia or France, would be impacted by lock downs in the coming weeks.

At present agricultural supply chains remain essential around the world. In addition, Russia is unlikely to want to limit the income received through wheat exports at a time when crude oil receipts have fallen.

Mulling over the risk of a disruption to supply chains, I was thinking about recent times when this was a major concern. We haven’t had any human pandemics (except HIV) in recent decades, but an analogous situation could be the annexation of the Crimea in 2014.

There were concerns that this short conflict between Ukraine and Russia would result in export difficulties, the reality was that the grain still flowed. The question will be whether the market will continue to price in the risk of supply chain disruption.

Fundamentally the world is forecast to produce a large crop during the coming year, albeit with the share of production held by exporters declining. This year is however likely to be one of extreme uncertainty, and a good grain marketing strategy is important.

Remember to listen to the Commodity Conversation podcast by Mecardo

What does it mean/next week?:

I don’t know what will happen in the next week, but I’d put money down that it will be volatile! At a local level grain prices remain strong.