A lot of poleaxing for little result

In a good week for grain growers the Aussie dollar is a bit lower, and international oilseed prices have found a bit of strength. CBOT Wheat steadied after a down week, which didn’t impact locally. All this translated into higher physical canola prices yesterday, and there might even be a bit more upside today.

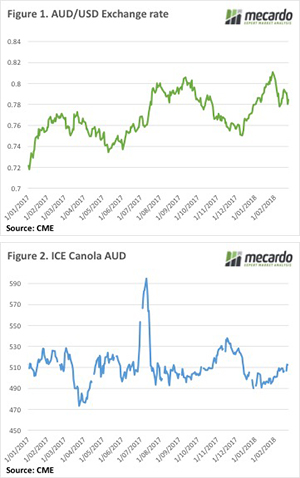

In looking for some commentary on the AUD exchange rate we found an article saying the Aussie had been ‘poleaxed’. Sounds promising for export orientated markets, but on further investigation ‘poleaxed’ translates into a 1% fall, with the Aussie at 78.4 US¢ this morning (figure 1).

If we were to use some of the terms we see in the financial press to describe grain prices this week we could say canola is rocketing higher, and wheat smashed lower. In reality ICE Canola has finished the week 1% higher at $508CAD/t (figure 2), and CBOT wheat 3% lower at 450¢/bu. We’d hate to see what financial reporters would make of the volatile commodity markets.

Locally there has been a bit of rain about, which usually loosens growers grip on grain, but we’ve seen a relatively flat week. Canola has returned to the ‘highs’ seen two weeks ago, but at around $500 port we are still a long way from December values, and at weak basis.

For those in the south, who have held onto canola, there is a bit of hope. Boats coming into Geelong and Portland might see some demand, and hopefully, basis improvement.

The week ahead

CBOT wheat came off on the back of a better rain forecast for key wheat areas, but this rain is yet to eventuate so there might be a bit of upside yet. As we keep saying, however, world wheat supplies are abundant.

Locally rain in NSW might encourage a bit of a sell off of cereal, but in reality there is not much grain up there so we can expect wheat and barley prices to remain steady.