A new month.

With a new month comes new opportunities. This week we take a look at the futures market and basis levels around Australia.

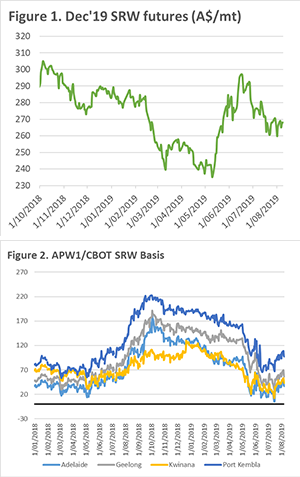

Let’s start with the global picture. The market has largely traded in a sideways motion since the end of July, with December Chicago futures up 1¢/bu. However, the falling A$ has led to an increase of A$3.

As we can see in figure 1, the gains of June have now largely dissipated with pricing levels back to mid-May levels and A$29 lower than the peak. The higher than expected yields in Europe are leading to a bearish undertone, nonetheless, the trade will be examining the forthcoming WASDE for some direction.

As we can see in figure 1, the gains of June have now largely dissipated with pricing levels back to mid-May levels and A$29 lower than the peak. The higher than expected yields in Europe are leading to a bearish undertone, nonetheless, the trade will be examining the forthcoming WASDE for some direction.

Although international markets are typically our biggest driver of prices in Australia, memories of the recent 12 months tell us that we can go it alone. The basis levels during last season were record high, but what about this coming harvest?

At present, the basis levels for the major Australian ports have declined and are now back to the same levels as this time last year. These levels are obviously high in areas of deficit (east coast), however far from the peaks.

The basis levels for new crop have been improving in recent weeks, although the recent rains in Victoria and South Australia will likely temper some of the gains. There is a lot of water to go under the bridge between now and harvest – so a nervous environment is likely to persist.

Remember to listen to our podcast

Next week?:

The WASDE report will be released next week which will provide some clarity on supply of both wheat and corn. The question of the validity of USDA forecasts always remain but it’s still a market driver.

The recent rains in Victoria and South Australia will provide some confidence to producers, but will it push buyers away from the market?