A positive result (and not for Covid19)

Improved finished cattle prices were noted this week as supply metrics begin to normalize, particularly for east coast cattle slaughter. Department of Agriculture, Water and Environment beef trade statistics for April show Chinese demand for Aussie beef recovering strongly too as an added positive sign for producers.

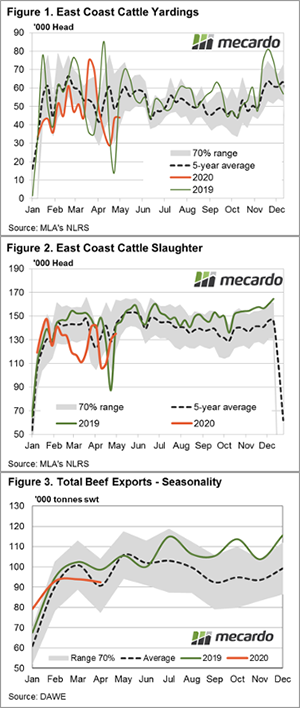

East coast cattle yarding levels have held firm at around 45,000 head for the final week of April and the first week of May, indicating some stability is returning to the market after some wild swings pre-Easter (Figure 1).

Weekly throughput remains 20% below the five-year trend but is within the normal range for this time in the season, as represented by the grey shaded 70% range zone. In an interesting dynamic between state yarding levels, Queensland is running 25% above the five-year trend as of early May. However, NSW cattle yarding is well below normal at 53% under trend. This is contributing to the lower than average total east coast figures and is perhaps a sign of the appetite in NSW from producers to restock.

East coast cattle slaughter numbers have returned closer to the five-year trend, to sit just 5% below with around 135,000 head processed in the first week of May (Figure 2). Since the Easter lull, slaughter volumes have increased 27% and the return to relatively normal operations have seen demand pick up for finished cattle this week. The National Heavy Steer (CV19) indicator has lifted 4.5% since the end of April to close at 320¢/kg lwt (as at 6th May).

In further promising signs for beef producers, beef export flows were above the five year average pattern in April (Figure 3). While US flows remain very subdued, a strong increase in exports to China is a good sign that their economy is getting back on track post their COVID-19 shutdown. There will be more to come on this in the Mecardo analysis piece next week.

Next week?

Tight supply and a favourable rainfall forecast continue to favour cattle producers and provide underlying support to prices. While there are headwinds in the form of a disrupted US/global economy, low global cattle prices, and a strengthening Australian dollar, the sign of a re-emerging China should tip the balance towards a more optimistic outlook for prices, at least for the short term.