A price pattern for all seasons

Key points:

- Analysis of annual rainfall deciles over the last century shows that the chance of back to back wet seasons lasting longer than two years is uncommon

- The most recent transition from a wetter than normal to a drier than normal period was over the 2011/12 seasons

- The current season is showing some price movement and slaughter pattern similarities to the 2011 and 2012 seasons

The 2016 season was without doubt the wettest for the nation since the 2010/11 deluge and has been the underlying cause of optimism among restockers, encouraging a rebuild of the herd and supporting young cattle prices to record highs. The recent rains have provided a boost to cattle prices over March – but could the prospect of a dry second quarter in 2017 and 50/50 chance of El Nino developing later in the season signal the beginning of the end for further increasing cattle prices?

The 2016 season was without doubt the wettest for the nation since the 2010/11 deluge and has been the underlying cause of optimism among restockers, encouraging a rebuild of the herd and supporting young cattle prices to record highs. The recent rains have provided a boost to cattle prices over March – but could the prospect of a dry second quarter in 2017 and 50/50 chance of El Nino developing later in the season signal the beginning of the end for further increasing cattle prices?

Analysis of annual rainfall deciles across the nation since 1900 shows that the chance of back to back wetter than average years going beyond a two-year period is fairly rare, with a much drier than normal season often following up within the next two years. Indeed, over the last decade the much wetter 2010/11 seasons were followed up with a rainfall deficient 2013, 2014 and 2015 to much of the east coast, prompting a significant cattle turnoff during that time.

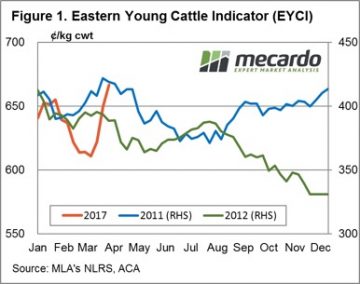

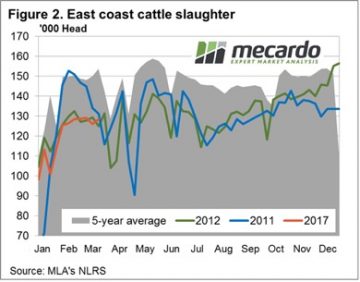

Figures 1 and 2 highlight the price and slaughter patterns comparing the current season to the 2011 and 2012 years. Interestingly, all three seasons have seen price increases for the Eastern Young Cattle Indicator (EYCI) over February/March. While the 2017 rally looks impressive, in percentage terms it is not too dissimilar to the gains recorded during 2011. The EYCI rose 8.2% over February/March 2011 compared to the 8.6% gain seen this year, albeit over a shorter timeframe. In terms of the weekly slaughter pattern there was a bit more volatility in the series during the first half of the year in 2011, although the 2012 pattern has been a reasonably good template for the current season, so far.

Figures 1 and 2 highlight the price and slaughter patterns comparing the current season to the 2011 and 2012 years. Interestingly, all three seasons have seen price increases for the Eastern Young Cattle Indicator (EYCI) over February/March. While the 2017 rally looks impressive, in percentage terms it is not too dissimilar to the gains recorded during 2011. The EYCI rose 8.2% over February/March 2011 compared to the 8.6% gain seen this year, albeit over a shorter timeframe. In terms of the weekly slaughter pattern there was a bit more volatility in the series during the first half of the year in 2011, although the 2012 pattern has been a reasonably good template for the current season, so far.

The second and third quarter of the 2011 and 2012 season saw young cattle prices ease from their peak in late March, bucking the common seasonal trend towards higher cattle prices during Winter. During the final quarter of 2011 and 2012 the EYCI diverged as the forecast of a very dry 2013 saw cattle slaughter in the final months of the year continue to climb, pressuring prices lower toward the year end.

Figure 3 focuses on data from the last two transitions from a wet to dry period and how the percentage price movement of the EYCI responded over the season. Overlaid on the chart is the percentage price patterns for 2017, 2011, 2012, an average of the 2011 and 2012 pattern and a potential seasonal range (calculated from the most recent five seasons that experienced a shift from wet to dry conditions).

Figure 3 focuses on data from the last two transitions from a wet to dry period and how the percentage price movement of the EYCI responded over the season. Overlaid on the chart is the percentage price patterns for 2017, 2011, 2012, an average of the 2011 and 2012 pattern and a potential seasonal range (calculated from the most recent five seasons that experienced a shift from wet to dry conditions).

What does this mean?

The analysis suggest that it will be unlikely to see the EYCI peak beyond 10-12% from the season opening price of 635¢’kg cwt, which would place the potential peak this year at 700-715¢. At this stage, the peak is still anticipated during Winter, with prices staging a decline in the final quarter of the year as the prospect of a return to drier conditions prevail. The magnitude of the correction lower for the EYCI is anticipated to be in the 10-15% range scheduled for late 2017 or early 2018, towards the 550-570¢ level.

Due to the Easter break this is the last analysis piece to be released this week. The usual Friday market comments will be released on Thursday – have a safe and happy long weekend.