A relatively sedate week

After weeks of ‘excitement’ in the grain trade, it’s a relief to see a relatively sedate week. In this week’s comment, we look globally and locally. We also revisit the forward curve, and the opportunities for locking in forward swaps.

Let’s start globally, by taking a look at futures. In figure 1, I have plotted the spot futures. The market closed at a low of 402¢/bu this week, however overnight has regained some composure to close at 409¢, however ultimately is down 5¢ on the week. This is a fall of around A$2/mt which in the overall scheme of the previous weeks falls is miniscule. The market is treading water whilst we await more data, however with the northern hemisphere weather risk market close to an end the signs are not good, and growers need to make sure their strategy reflects this.

Let’s start globally, by taking a look at futures. In figure 1, I have plotted the spot futures. The market closed at a low of 402¢/bu this week, however overnight has regained some composure to close at 409¢, however ultimately is down 5¢ on the week. This is a fall of around A$2/mt which in the overall scheme of the previous weeks falls is miniscule. The market is treading water whilst we await more data, however with the northern hemisphere weather risk market close to an end the signs are not good, and growers need to make sure their strategy reflects this.

Yesterday I examined the proposition ‘Can basis save us?’, ultimately it cannot save us, but it can insulate us at times from the rest of the world. In figure 2, the basis levels are displayed, In recent weeks basis levels have traded in a narrow range, however maintaining at strong levels. At present grower selling is low and sporadic, therefore the question remains of what will happen when harvest arrives and growers start to sell.

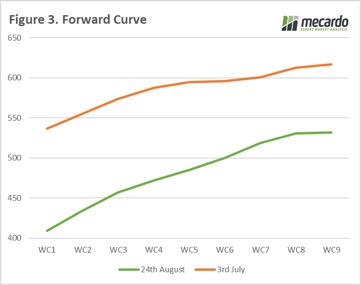

In early July we recommended the use of a Dec’18 Chicago swap in our article ‘Should we lock a far forward swap?.’ In figure 3, we have compared the wheat forward curve for yesterday and the 3rd July, when the prior article was written. In that time the Dec’18 wheat futures have fallen A$42/mt stripping away the opportunity which was present.

In early July we recommended the use of a Dec’18 Chicago swap in our article ‘Should we lock a far forward swap?.’ In figure 3, we have compared the wheat forward curve for yesterday and the 3rd July, when the prior article was written. In that time the Dec’18 wheat futures have fallen A$42/mt stripping away the opportunity which was present.

What does this mean?

The focus firmly remains on the Northern Hemisphere. There are a few questions still remaining; How close have USDA estimates been to reality on both the wheat and corn crop?, how is the quality profile stacking up in France and Germany?, What will the Canadian spring wheat perform?

We have always advocated having an appropriate risk management strategy, to ensure that you are able to weather the storms as they develop.

The futures prices seen in July, are unlikely to be seen again this year, and we have to prepare for that.

The futures prices seen in July, are unlikely to be seen again this year, and we have to prepare for that.