Alpaca – leading the way?

Alpaca numbers in Australia are estimated to be between 170,000 and 450,000, with the higher estimate considerable in view that the sheep flock only numbers around 70 million. Wool ranging from 24 through to 26.8 micron is blended with alpaca. The combination of alpaca numbers and some relationship of the alpaca fibre to wool are behind this brief look at this ancient luxury fibre.

In volume terms Alpaca is middling amongst the animal fibres, on par with mohair and angora volumes. Table 1 shows the estimated world production for 2015 of all fibres (96 million tonnes) and then by animal fibre which ranges from wool (the largest animal fibre) down to guanaco fibre which has an annual production around 2 tonnes.

Some 80% of world alpaca production comes from Peru and Bolivia with three quarters of this production now going to China for processing. In these trade flows alpaca reflects what goes on in the wool market.

Sources from the wool supply chain indicate that 24 to 26.8 micron wool (26.8 being the old Chinese crossbred blend Type 423 which has an average fibre diameter of 26.8 micron) is blended with alpaca. The 24 to 27 micron categories make up 8-10% of wool supply as a rough estimate, which means there is plenty of 24-27 micron wool to blend with alpaca.

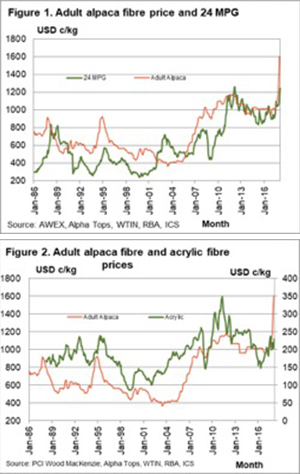

Figure 1 compares the 24 MPG and adult alpaca fibre price from the mid-1980s onwards in US dollar terms. Like wool there are a range of alpaca fibre grades related to fibre diameter and the ability to dye (whiter the better for this). In this article the lowest value, adult fibre, has been used in price comparisons. Figure 1 shows the alpaca and 24 micron price series to spend some time positively correlated and other times negatively correlated. The 2002 rally in the 24 MPG was part of the post stockpile liquidation cycle, specific to wool. This cycle upsets wool price relationships generally. If we chop out the 2002 to mid-2004 period, on the assumption we have no stockpile liquidation to worry about since then or in the foreseeable future, the correlation between these two series rises to a respectable 0.69, meaning wool prices can explain nearly 70% of the change in alpaca prices.

In recent years the adult alpaca and 24 MPG have followed a very similar path. Now, note the sharp rise in the alpaca price since the second half of 2017. The price is up by around 60%, and the price gap between alpaca and wool has widened considerably. The temptation to increase the blending of wool into alpaca will be rising.

Figure 2 compares adult alpaca and an acrylic fibre price series from the mid-1980s onwards, in US dollar terms. While the basis between the two series varies, the general trends match up. Rolling 5 year price percentiles for each fibre follow each other quite closely, so the relative expensiveness/cheapness of acrylic fibres is matched by alpaca.

Key points:

- Adult alpaca fibre price have a good correlation with the 24 MPG.

- Since mid-2017 the adult alpaca price has risen by a round 60%, with the gap between alpaca and wool prices widening markedly.

- The general trends in acrylic fibre prices are matched by trends in alpaca prices.

What does this mean?

Recent marked rises in alpaca prices (the adult price is quoted up by some 60% since mid-2017) are of interest for the 24-27 micron wool categories. As alpaca and 24 micron prices have generally had a strong positive correlation, the lift in alpaca price should be supportive for 24-27 micron prices. Acrylic prices have not changed greatly so there is not supporting move in manmade fibres, which might be a limiting factor.

| Table 1: 2015 estimated animal fibre world production | |

| Fibre | Annual volume tonnes |

| All fibres | 96,354,000 |

| Clean Wool | 1,160,000 |

| Silk | 170,000 |

| Cashmere | 28,760 |

| Mohair | 6,260 |

| Alpaca | 6,000 |

| Angora | 5,630 |

| Yakhair | 4,170 |

| Camelhair | 2,775 |

| Llama | 2,500 |

| Vicuna | 7 |

| Guanaco | 2 |

| Source: IWTO | |