Another week, another rise in export prices

The Aussie dollar was higher thanks to improving prospects for China/US trade, and declining chances of an interest rate cut next week. This had little impact on export prices however, with higher US value-driving export prices higher.

The story is the same, Chinese demand is diverting product away from the US and importers are scrambling for available lean manufacturing beef. Our slaughter rates remain relatively high, but the Chinese seemingly have more money than the US at the moment.

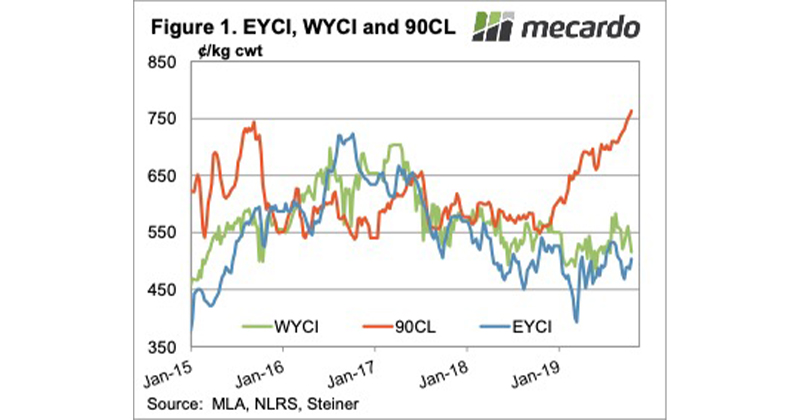

Figure 1 shows that the 90CL Frozen Cow indicator has rallied with only a couple of hiccups for the last 11 months. Needless to say, current prices are at record levels. Figure 1 also shows how far behind the Eastern and Western Young Cattle Indicators are.

This time last year local young cattle prices were at a small discount to the 90CL, now export prices are the only thing holding young cattle prices at reasonable levels.

Cattle price moves were rather benign this week. Slaughter cattle remain very well priced. The most expensive indicators in the country were the Queensland and Victorian Heavy Steer, at 568¢/kg cwt.

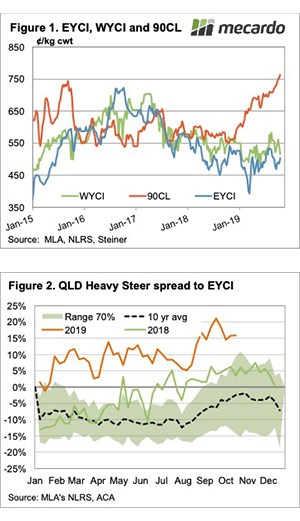

The Queensland Heavy Steer premium to the EYCI has fallen from 20% to 15% (Figure 2), and it’s well above the same time last year. With export beef in demand and young cattle not so much, this isn’t a surprise.

Next week

With no real rainfall on the forecast, we can expect more of the same for the coming week. For markets to go lower, either export markets need to fall, or cattle supply increase. At this stage it’s hard to see either of these things happening, so we continue to wait for rain for the upside.