Are you on ICE?

The canola market has seen a surge in pricing levels since harvest commence. This has been beneficial to producers who generally wait until harvest before selling their canola. In this update, we take a look at the basis between ICE canola futures and local pricing.

There are two main canola futures contracts ICE (Canadian canola) and Matif (French rapeseed), in this update we will be taking a look at the basis between ICE and Australian pricing levels.

Canada is an important canola producer, with the country producing on average 28% of the world’s canola crop over the past five years. Most of the canola grown in Canada is genetically modified, whereas the majority of the Australian canola crop is non-gm.

In a typical year Australia will export the majority of the Canola produced, which aligns itself well with the logic behind using ICE futures as Canada follows a similar trade flow.

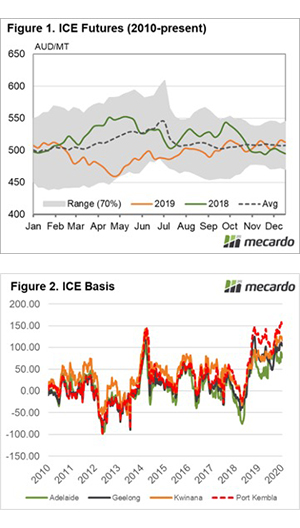

In figure 1, the seasonality is shown for ICE futures (converted in A$/MT). In these seasonality charts, rather than use a min/max for the seasonality banding (green shaded area), we use a 70% range (or 1 standard deviation). The 70% banding is used to remove the extremes in the marketplace, which we believe gives a better indication of the seasonality, as opposed to a min/max which can be extremely volatile. In these charts, we also overlay the average for the timeframe and the recent seasons.

During mid-year of 2019 ICE canola futures traded at the bottom end of the range, however, they have drifted higher throughout the year albeit are only now trading at the average for the past decade. If we follow the seasonality, we tend to see the largest rises in the middle of the year. This corresponds with the northern hemisphere weather risk period, and a similar pattern is evident in wheat.

In figure 2, the basis between ICE and local canola prices is displayed. As we can see the local price has increased versus the rest of the world to record levels (Port Kembla). At present basis, levels are extremely strong. The strength in basis levels is due to scarcity of supply, and we shouldn’t expect to see these levels repeated in 2020/21 unless we see further supply shocks locally.

Remember to listen to the Commodity Conversation podcast by Mecardo

What does it mean/next week?:

The Australian market is currently trading at very strong premiums to Canadian canola futures. It is highly probable that these basis levels will decline next harvest (if we have an average crop).

At present, I recommend using physical sales of canola, whilst the market remains strong.