Being negative is not always a bad thing

Key Points

The extraordinary times continue with crude oil crash into negative territory. In this update, we look at wheat futures (overseas and locally) and a brief discussion on negative crude oil.

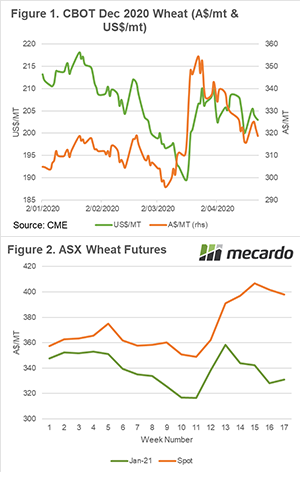

Wheat futures rose at the start of the week, as concerns mounted of dryness in Russia and concerns that they would curtail their exports. The market has since retreated, however, remains higher than last week. In Australian dollar terms, the December Chicago futures contract has traded between A$325 and A$319, with the market currently A$3 above last Friday.

At a local level, ASX futures have lost some ground since hitting its current year high two weeks ago (at a spot level). The spot market has rallied during March from A$348 to hit A$406 a fortnight ago, it has now fallen back to A$397.

The inverse between new crop and old crop remains high at A$67. As we move closer to new crop the spread between the two will converge, either new crop will rise to meet old crop or vice versa. As the crop develops and things become more assured, I’d put my money on old crop falling to meet new crop.

At present, the basis between ASX Jan 2021 and Chicago Dec 2020 futures is currently +A$10, which is incredibly low level compared to recent years.

The current environment makes for interesting developments. During this week, the crude oil market fell to -$37/barrel. This was always a theoretical possibility; however, I don’t think many actually thought they would see the day that you could be paid to receive oil.

This is a relatively common occurrence in some industries such as natural gas or electricity. In this instance, the oil ran into negative values, due to the expiry of the May contract. At this point, those who were long WTI futures did not want to take physical delivery. This meant those holding contracts were looking for buyers who were scant on the ground.

A market with more sellers than buyers and rapidly filling storages meant that the price fell into negative territory. This problem is likely to arise as we come to the expiry of the June contract and bodes well for continued low fuel pricing.

It has however meant that ethanol and ergo corn prices are under some pressure. As per our prior analysis, corn & wheat have a strong correlation. Nonetheless wheat has diverged somewhat over the past couple of months.

What does it mean/next week?:

What’s going to happen next week? In this environment who knows. Presently the wheat market is still supported at current levels, however, an uncertain environment brings uncertainty.