Canola find some strength still waiting for wheat

Another week, and another week of relatively flat prices for wheat. There was some upside for canola in international markets, which is providing some opportunity. There has been some talk around regarding CBOT wheat being primed for a spike, and there might be something in it.

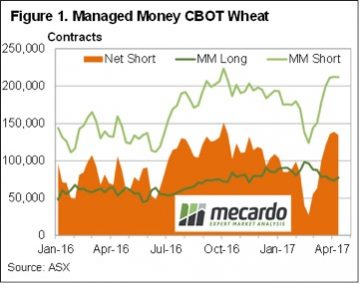

Earlier this week we took a look at some of the production data US wheat markets take note of, and there is also some data which shows how traders react. The CFTC Traders Summary tells us what type of trader holds long or short positions in CBOT wheat.

Earlier this week we took a look at some of the production data US wheat markets take note of, and there is also some data which shows how traders react. The CFTC Traders Summary tells us what type of trader holds long or short positions in CBOT wheat.

The most interesting data in the Traders Summary report comes from the Managed Money positions, where they report how many are long and how many are short. Figure 1 shows the Managed Money short positions have been climbing stronger, and sit close to an 18 month high. The Net Short, that is the number of short positions minus long positions, also sits close to a high.

This basically means that speculators are punting on wheat prices falling, as they are heavily sold. While this is the general feeling in the market, it does bring opportunity. If something does go wrong with production somewhere, there are a lot of sold positions which will need to be bought back in a hurry, which can add impetus to any price rally.

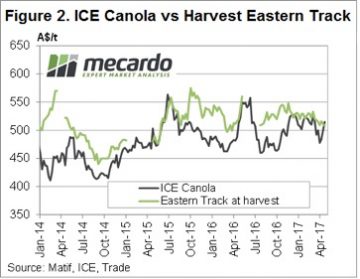

Canola has found some strength in Canada this week as wet weather delays sowing. The spot ICE contract rallied over $30 to $520/t, while Jan-18 gained $15 to sit at $497/t today. With the weather forecast not looking favourable for sowing, there could be some more upside for Canola.

Canola has found some strength in Canada this week as wet weather delays sowing. The spot ICE contract rallied over $30 to $520/t, while Jan-18 gained $15 to sit at $497/t today. With the weather forecast not looking favourable for sowing, there could be some more upside for Canola.

The week ahead

With Anzac Day, and rain falling last week, conditions for sowing are almost ideal. Any grain growers who haven’t started yet will be well and truly underway next week, and old crop selling into delivered markets might slow. This could see some improvement in local basis, but I’m not sure I’d want to be a seller in 6 weeks’ time when growers look to quit some stocks.