Canola & Rape futures.

Canola is starting to be harvested but a cloud hangs over the industry. With a massive hay program and dry finish, what will happen to yield and oil content? In this analysis, we take a look at canola basis versus Canada and France.

Two weeks ago, we wrote about canola pricing catching up with the drought conditions in the article “Canola: Finally catching up”. This week we will take a look at the canola futures market.

There is an Australian canola futures contract on ASX. However, it has no trading activity, therefore it is ineffectual. Farmers who are hedging using financial price risk management tools will then have to look overseas for a market.

If we are ignoring local derivatives, the main contracts are Canadian Canola futures (ICE) and French Rapeseed (Matif). The Matif contract is non-GM, whilst the ICE contract is GM.

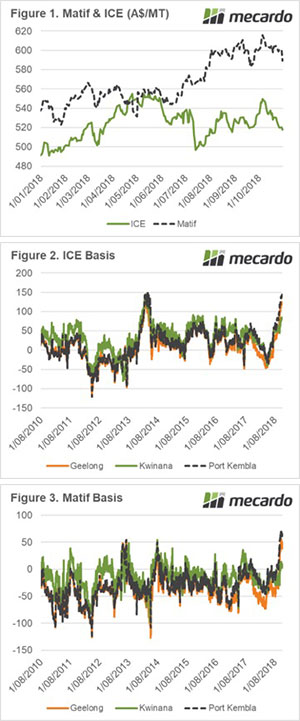

In Figure 1, the Matif and ICE spot contract is displayed in A$/mt. The Matif contract rose through July-September as drought conditions impacted upon the German and French crops. The ICE contract also followed the general market. However, in recent weeks, the market has lost much of its momentum and is sitting below the average from Aug-Nov.

The drought in Australia has drastically impacted canola production, therefore we would expect that the local premium (basis) against overseas futures would rise dramatically. In Figure 2 & 3, the basis between ICE and Matif is shown. Recent weeks have seen a sharp rise in basis levels over both contracts.

The premium over ICE is at the highest level since 2014 and is the highest against Matif during this decade. Typically, when these peaks are reached the market tends to experience a correction, but will this be the case this year?

What does it mean/next week?:

A high basis level usually suggests that it is time to start selling physical. However, a huge amount of uncertainty remains around canola production levels (& oil content). The east coast has a likely deficit of supply which will place pressure on crushers as they move into the new year.

The risk of seed imports is low, however, oil consumers can easily switch to imported canola oil to meet their requirements.

I am confident of strong prices into the new year, however I would advocate for a bite sized selling program as the seed comes off the header.

Key Points

- Canola prices have risen dramatically in the past month.

- The price increase is attributed to local

- Basis levels against both ICE (Canada) and Matif (France), are at their highest levels since the start of the decade.