Canola where the action is

This week’s new season World Agricultural Supply and Demand Estimates (WASDE) were somewhat of a letdown, in terms of impact in prices. We have however seen some movement in local markets, notably for new crop canola and old crop wheat.

Old crop canola prices have been frustratingly sticky, for those who are still holding onto inventory. The market is stuck around the $520-525 port level, or $540 delivered Melbourne. This is a slight discount on harvest, so not much has been gained or lost through holding Canola.

Old crop canola prices have been frustratingly sticky, for those who are still holding onto inventory. The market is stuck around the $520-525 port level, or $540 delivered Melbourne. This is a slight discount on harvest, so not much has been gained or lost through holding Canola.

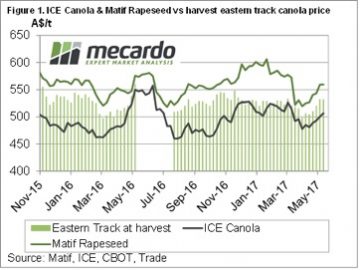

Figure 1 shows that new crop Canola has had a nice little rally in recent weeks. Concerns surrounding sowing weather in Canada has given ICE Canola a lift. The AUD has lost 5.5% relative to the Euro in the last month, which along with a small rise in MATIF Rapeseed, has seen the European contract add $40/t in our terms.

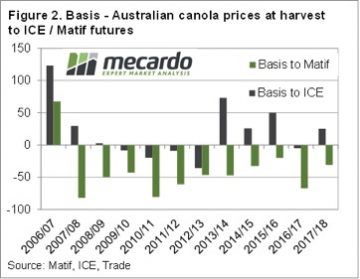

Local Canola prices for 17/18 have lifted in line with futures, with bids this week around the $530/t port level. Interestingly, basis on these forwards to both ICE and MATIF are currently much stronger than at the last harvest. However, they remain below the levels of the three years previous.

Since Anzac Day delivered wheat and barley prices have gained some ground. With growers busy on seeders, no one is driving the trucks so this market has tightened somewhat. SFW wheat has hit $218/t delivered Melbourne, while F1 Barley is up to $200. These prices are 10-20% better than harvest, and are worth considering.

Since Anzac Day delivered wheat and barley prices have gained some ground. With growers busy on seeders, no one is driving the trucks so this market has tightened somewhat. SFW wheat has hit $218/t delivered Melbourne, while F1 Barley is up to $200. These prices are 10-20% better than harvest, and are worth considering.

The week ahead

The WASDE report this week was largely in line with expectations, but it did predict a decline in world oilseed stocks this year, which might provide impetus for Canola markets if there are some production problems.

For local delivered markets this might be a sweet spot for selling. There is likely to be a bit of supply come on once sowing is finished, and especially in the new financial year, so locking some pricing in now might be a good idea.