Cattle off highs but far from disaster

Key points:

After battling with drought for over two years Australian cattle producers are currently the envy of global cattle producers. In the US most notably, but also in South America and Europe cattle prices are tanking, while ours remain in the upper echelon.

Earlier in the week, we looked at US cattle values, with bottlenecks depressing prices now, and likely for most of the year as supply backlogs are cleared. In South America, uncertainty and falling kill rates have also impacted price, but not the extent of the US yet.

Here cattle markets have remained relatively resilient. No doubt the post-drought tight supplies, and strong demand from restockers has helped on the east coast, but in WA prices remain similarly strong. In fact, the MSA Yearling is at 590¢/kg cwt, over the hooks, which is a few cents higher than NSW.

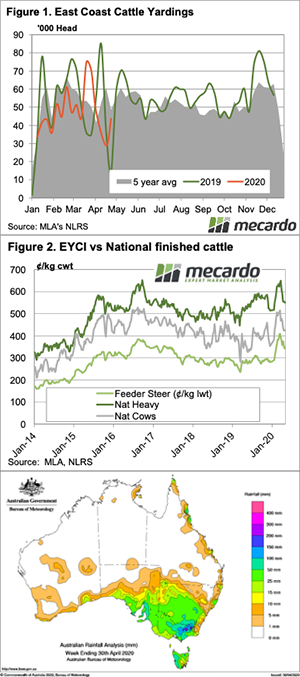

Supply hasn’t improved after the Easter break, last week languishing well below average on the east coast (figure 1). There are no surprises here, with tight supply being exacerbated by a shift to online selling.

With supply down, demand has eased somewhat to match it. After the initial fall, saleyard prices have steadied (figure 2). Historically cattle prices are still very good, with the National Heavy Steer Indicator at the 89th percentile, Feeders at the 88th and Cows at the 83rd over 15 years. Prices have been a lot better in recent times, but historically prices this strong are a rare occurrence.

Meat and Livestock Australia (MLA) released their cattle projections this week, and it seems cattle supplies are going to stay tight. Next week we’ll have more on what this means for price.

Next week.

If the southern autumn break hadn’t arrived, it did this week. Figure 3 shows widespread rains in all key southern cattle areas this week, and this is likely to ensure supply remains tight.

Young cattle demand is unlikely to weaken, but store prices can only hang on as long as finished cattle prices stay at solid levels. The finished market test will come when US slaughter ramps up again, and we see some real price competition in Japan and Korean markets.