China wades back in despite higher A$

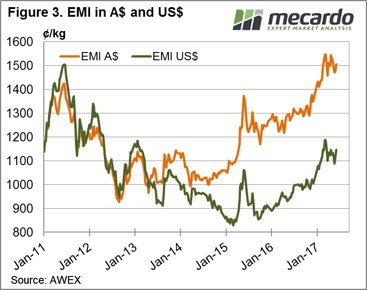

Increased demand this week from exporters noted as Chinese buyers resume their activity, undeterred in the face of a higher A$. The EMI creeping back above 1500¢, up 28¢ to 1506¢ and gaining 31US¢ to 1146US¢. The Western markets resumed auctions this week and activity participated in the rally, making up for lost time with a 63¢ rise to see the WMI at 1567¢, up 58¢ in US terms to 1192US¢.

Increased demand this week from exporters noted as Chinese buyers resume their activity, undeterred in the face of a higher A$. The EMI creeping back above 1500¢, up 28¢ to 1506¢ and gaining 31US¢ to 1146US¢. The Western markets resumed auctions this week and activity participated in the rally, making up for lost time with a 63¢ rise to see the WMI at 1567¢, up 58¢ in US terms to 1192US¢.

Price gains for most categories of wool noted, although the medium fibres leading the charge higher with gains of 50-65¢ noted for microns between 20 to 23 mpg in the East and 90-110¢ gains for similar wool in the West. The rally in finer wool limited to a 15-50¢ range in all three centres.

Interestingly, the medium fibres displaying a more robust price movement this time around with the 21 micron reaching levels in AUD terms not seen since the middle 1988. Indeed, in May 2016 when the 21-micron hit 1535¢ in the South the 17 mpg was trading above $23 and the 19 mpg was above $19.5. This week with 21 mpg at 1549¢ the 17-micron unable to climb above $22 and 19-micron can’t crack the $19 level.

Interestingly, the medium fibres displaying a more robust price movement this time around with the 21 micron reaching levels in AUD terms not seen since the middle 1988. Indeed, in May 2016 when the 21-micron hit 1535¢ in the South the 17 mpg was trading above $23 and the 19 mpg was above $19.5. This week with 21 mpg at 1549¢ the 17-micron unable to climb above $22 and 19-micron can’t crack the $19 level.

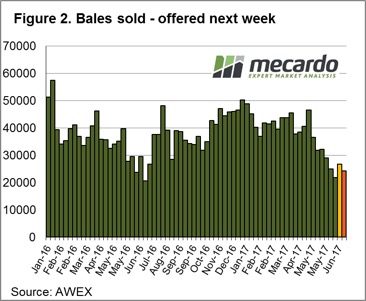

Some whispers around the traps that if the Chinese step away again the fine end could be in for a quick correction. Although, the prospect of higher US interest rates later this year could continue to play into wool grower’s favour. This week the US Federal Reserve lifted rates and because this was highly anticipated it had limited impact on the A$. However, any sign that the US will move to a more tightening bias or indications of more frequent potential future rate rises in the US could see the A$ come under reasonable pressure again, pushing it back toward the 70US¢ level. A relatively softer A$ now compared to back in 2011/12 helping to keep wool prices competitive overseas, despite the high local prices – figure 3.