Coronavirus – impact on grain?

Coronavirus is spreading around the world at a rate of knots. In the last week, we have been asked about the potential impact on demand for agricultural commodities due to this illness. In this report we look at the question – is coronavirus impacting on demand?

The Coronavirus has spread from Wuhan, China to 18 countries in a very short period of time. This has caused a great deal of consternation around the globe as countries enact quarantine protocols. Does this impact on markets?

I thought it was useful to give a few pieces of disease trivia:

- Spanish flu (1918-1920) is estimated to have killed up to 100m people or approximately 5% of the population.

- The black death killed up to 60% of the population of Europe, and it took 200 years to recover the population to pre-outbreak levels.

- SARS (2002-2003) infected 8098 people with 774 deaths.

As the number of disease cases increases the number of deaths follows. The daily increase in cases has averaged 60% since the outbreak started.

The mortality rate from coronavirus has averaged 2.6%. To put this in perspective 2019 was considered an exceptional influenza season, and the mortality rate was 0.19%.

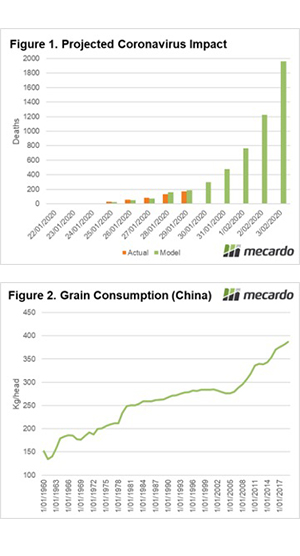

In figure 1, we have modelled the potential death toll from Coronavirus using an infection rate of 60% per day and a mortality of 2.6%*. This chart shows the actual and the modelled death toll. The model when back tested has closely matched the data originating from China.

If the outbreak continues to follow the trend, then 2000 people will have died by early next week.

In recent days there has been lots of talk about reduced demand due to this outbreak. In figure 2, the grain consumption per capita for China since 1960 is displayed. In this decade the average consumption within the nation (all uses) has averaged 354kg/hd, which is above the global average of 335kg/hd.

At this level, if 10m people were to perish due to coronavirus, demand would drop by 3.9mmt. Global trade flows are more likely to impacted by supply issues, as an example the average production of grain (wheat, barley & sorghum) in Australia this decade was 34mmt, last year we produced 24mmt.

*As the outbreak progresses we are likely to see infection rates and mortality dropping.

Remember to listen to the Commodity Conversation podcast by Mecardo

What does it mean/next week?:

The real drive down in price is most likely due to a risk off attitude, in conjunction with concerns related to the overall economic situation in China.

The real fundamental demand hasn’t at present changed. If we get to the level where deaths cause demand disruption, we will likely have more pressing concerns than the grain price.