Crisis? No crisis here.

Oil is crashing, the stock market is crashing, the Aussie dollar is lower, there is a massive spend on stimulus, the whole country could go into lockdown, but what about sheepmeat? Well, people have to eat.

The ‘people have to eat’ story is a good one, as it is true to an extent. The problem is, people don’t have to eat lamb cutlets for $32/kg, or rack roasts at $36/kg. If income and spending start to be impacted, it will be sausages and mince instead. Perhaps that is why mutton is on the move again.

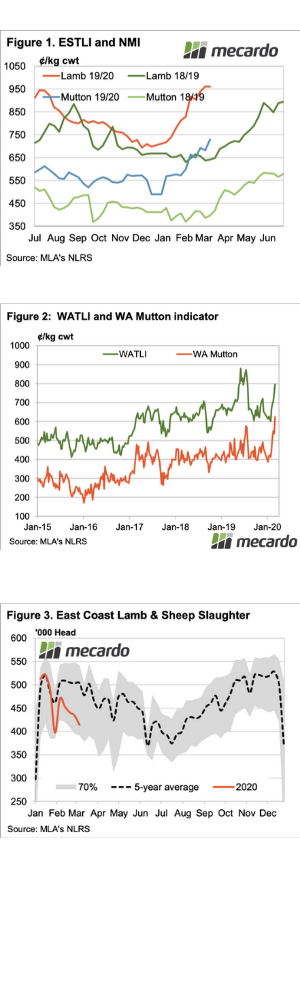

After a brief stall, the mutton rally continued, with the National Mutton Indicator posting yet another record of 729¢/kg cwt this week (figure 1). At the end of January, lambs were making this sort of money. At Hamilton today, most sheep sold over 800¢/kg cwt. The demand for mutton in export markets seems not to have been impacted by Covid19, or the tanking financial markets, yet.

The lamb rally did stall this week but held its ground at record levels. The Eastern States Trade Lamb Indicator (ESTLI) fell 1¢ to finish Thursday at 960¢/kg cwt.

WA is finally seeing some positive price action, with eastern states buyers competing with local processors. Figure 2 shows WA mutton is also at record levels, while lambs are just under 800¢.

Supply continues to slide. Figure 3 shows the combined sheep and lamb slaughter last week hit ‘average’ mid-winter levels. The flock rebuild appears to be in full swing.

Next Week.

Lamb and sheep producers might be worried about prices easing on the back of weakening demand, but there doesn’t seem to be enough stock out there to pressure the market lower. With restockers still paying over 1000¢ for store lambs, they don’t seem to be concerned either.