Data brings certainty or uncertainty?

The USDA report surprised most stakeholders within the industry this week. It wasn’t a welcome surprise with prices declining across the board. In this update we take a look at the impact on pricing, and how Australian pricing is remaining strong.

This time last week there was a lot of anticipation by market participants of the forthcoming USDA reports. After false start 19/20 reports in July, the August reports were going to provide some much-needed clarity on the corn crop. It would give some certainty to how many corn acres had been abandoned. The reality was that the report had acreage and yield higher than most analyst expectations.

The result of such a bearish report on corn was as could be expected, falls in prices across the board. In A$ terms December futures retreated 5% or A$13.5/mt. This is a substantial fall and places December wheat futures back at the same level as mid may removing all the value of the June rally.

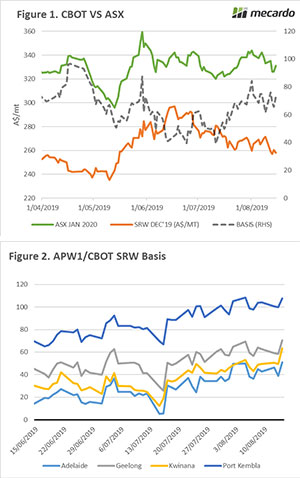

At a local level the ASX contract fell from A$342 last week to A$326, but has since rebounded to A$331 (figure 1). The basis between ASX and CBOT increased dramatically during July as CBOT declined and ASX remained stubbornly in a narrow trading range. This basis is since although conditions are reasonable (touch wood) in Vic/SA both NSW/QLD are in dire straits.

In figure 2, the basis levels between CBOT & new crop pricing around the country are displayed. As we can see all areas have increased. The biggest increase is in the Port Kembla zone which is a region unlikely to provide much to the Australian wheat balance sheet this season. This season will see continued movements from the south to the north to meet demand, this flow will likely to continue unless there is a strong sorghum crop.

Remember to listen to our podcast

What does it mean/next week?:

The 8 day forecast shows good falls for much of the southern cropping regions. As has been the case throughout this season (and the last two) the north is missing out.

If the USDA data is correct and is maintained through future updates, it is likely that globally we will maintain a low pricing environment. In Australia however basis will remain strong on the east coast whilst local demand remains strong and supply is short.