Demand driving cattle prices higher

Cattle markets have opened 2017 with a bit of a bang,

with extraordinary restocker demand, and very good

feeder demand driving prices higher. Cattle supply in

saleyards has been similar to last year, so it would

seem demand is the driver.

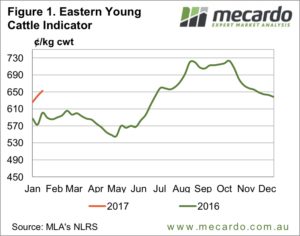

The Eastern Young Cattle Indicator (EYCI) has

rallied back above 650¢/kg cwt this week, hitting a

six week high (figure 1). With the dearth of quotes for

the cattle market last week, it’s hard to pinpoint who

is driving the stronger prices. However, with the east

coast trade steer sitting at 632¢, and feeder cattle

around 10¢ higher, it would seem restockers are

dragging the EYCI higher.

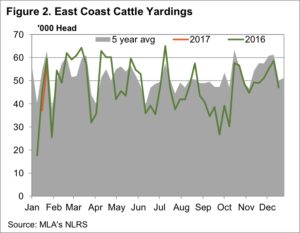

East Coast cattle yardings rallied higher this week,

which is not unusual as normal sales resume. Usually

the pent up supply from the break sees prices move

sideways in January, but it appears it is pent up

demand pushing prices higher.

Some recent rain in Queensland has no doubt helped

push demand in the north, but large parts of

southern Queensland and NSW are still 25-100mm

below the January average.

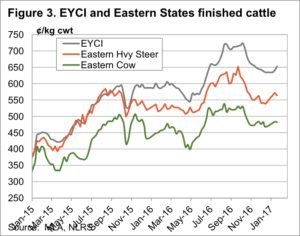

After opening up much stronger, heavy steers eased

marginally this week (figure 3) as the strong price

drew out supply, while cows were also a little lower.

Despite the wide spread between finished and store

cattle prices, the numbers seem to still be working for

those purchasing expensive young cattle.

The Week Ahead

There has been a few positives for the cattle market of late,

and this has resulted in higher prices early this year.

Add to this the widespread rain which is forecast

for the next week and we could see a little more

upside for prices in the short term.

However, unless we see a strong rally in export values,

it’s hard to see cattle getting back to the levels of last

spring, with 5% upside probably the limit.