Does the forward curve support producers or consumers?

Does the market structure at present offer an opportunity for producers, consumers or both to reduce their price risk for the 2019/20 harvest? In this article, we examine both local and overseas futures to provide some options for hedging.

It is always of great importance to look beyond the current harvest and towards the horizon. This is equally important for both producers and consumers.

The bulk of the wheat price received in Australia is the futures element, with the predominant contract being the Chicago contract (CBOT). In a typical year, basis would account for around 30% of the overall price, in a drought year like present, this will increase substantially.

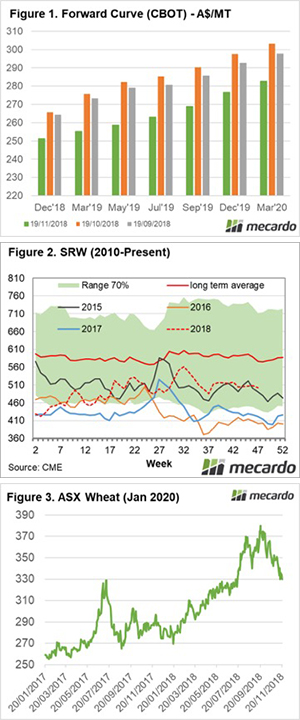

The forward curve remains in contango, where forward contracts are at a premium to spot. At present, the December 2019 contract is at A$276, a A$22 drop from this time last month (Figure 1). This is clearly less attractive for hedging for growers, however, it does provide a much more attractive opportunity for consumers.

This is the lowest level since mid-July, providing a solid floor to start the procurement process for the 2019/20 season. There is a long way to go between now and next harvest and hiccups in the northern hemisphere could lead to substantial price rises. This is especially true during the northern hemisphere risk period where we have seen strong movements in recent years during the mid-year (Figure 2).

What about for producers? In mid-August, I highlighted the opportunity for producers to hedge using ASX for Jan 2020 (see article) and also how this strategy could be used by consumers (see article) in September. At this time, it was possible to lock in A$380 for January 2020. I know that several producers did follow this strategy and the market has now fallen to A$330 (Figure 3). This provided an effective return of A$50p/t.

The market is clearly not as attractive now for producers as it was a month ago, however, A$330 still provides a reasonable base for hedging. This is still a return higher than in recent years.

I generally opt for a risk mitigation strategy where the marketing process is conducted in chunks. This leaves room to continue to participate in any upside, but also not been completely exposed to a market trending downward. It comes back to the old saying, how do you eat an elephant? One bite at a time.

What does it mean/next week?:

The market is currently offering potential strategies for both producers and consumers to reduce their price risk for the 2019/20 season.

The market is very volatile, with local and international conditions for next year on a potential knife edge. No-one knows where the market will be in >12months time, therefore it is prudent to consider strategies to reduce risk, even if only biting a small chunk.

Key Points

- December 2019 Chicago futures are down $22 to $276 from this time last month.

- ASX futures for January 2020 have lost some shine falling A$50 to $330 from highs in September.