Expensive stores should turn a profit on grass

Trade Lamb prices are continuing to defy gravity, and carrying other categories along with them. Store lamb prices are at record highs for October, and some forward contracts have just been released. The equation is pretty simple for January, when prices can be locked in, with profits likely to be smaller for lambs sold in December.

Trade Lamb prices are continuing to defy gravity, and carrying other categories along with them. Store lamb prices are at record highs for October, and some forward contracts have just been released. The equation is pretty simple for January, when prices can be locked in, with profits likely to be smaller for lambs sold in December.

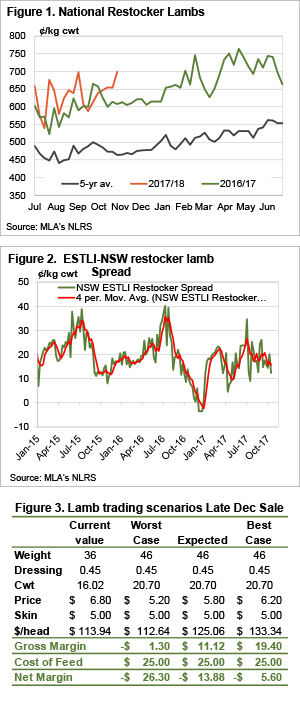

The recent strength in lamb prices has restockers starting to get a bit excited. Figure 1 shows a strong rally in the National Restocker Lamb Indicator last week, as it sits at 699¢/kg cwt. In dollar per head terms the indicator is sitting around $105 per head.

There is usually plenty of variability in the restocker price in ¢/kg terms, as the average weight can change week to week, and sometimes this doesn’t impact the dollar per head price as significantly as it would for trade or heavy lambs.

Restocker lambs are now at a record level for this time of year, and sitting around 90¢, or 15% above the same time last year.

If we assume trade lambs weigh 20kgs cwt, and restocker lambs 16kgs, and skin values is the same, the spread between restockers lambs and the ESTLI in dollars per head is shown in figure 2. The ESTLI premium has been creeping lower, and at the end of last week sat at $12.4/head. Basically this means 20 kg cwt trade lambs were making just $12.4 more than 16kg cwt restocker lambs.

Generally a narrow spread between restocker and trade lambs is driven by abundant feed, as producers opt to hold lambs in favour of weight gain, forcing store buyers to pay more. So the question is whether there is any money in buying lambs are current prices.

Figure 3 shows some rough numbers on buying lambs at current prices, and selling at our worst, expected and best case price scenarios. Finishing on grass, and getting the current trade lamb price will provide a pretty good return, which is what buyers are banking on.

What does this mean?

Getting the current price of around 630¢ would be our best case scenario, as we think there will still be a flush of lambs, and lower prices in December.

Our expected price for December is 580¢, which is likely to be close to break-even after costs are taken out, while a loss will be made at last year’s December price of 520¢/kg cwt. Obviously it is hard for those feeding lambs at the moment, with store lamb prices, grain prices and finished lamb prices not really stacking up unless prices continue to rise.

Just yesterday forward contracts were released for January ranging from 580¢ to 630¢. If lambs can be carried that far on grass then a profitable outcome should be able to be locked in now.