Flush nearing completion.

Victorian lamb numbers continue to swell, hitting levels similar to last year’s peak and pushing East coast lamb numbers to levels not seen since January 2018. Sheep numbers at the sale yard have also rebounded over the last few weeks and the result has been softer lamb and mutton prices across the board.

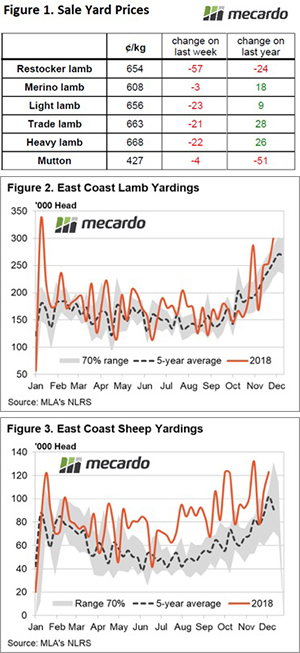

East coast sale yard prices for the commonly NLRS reported categories of lamb and mutton are outlined in Figure 1 and it shows that the increased throughput having an impact on all prices, although only minor falls registered for Merino Lamb and Mutton.

Restocker Lambs taking the biggest hit with an 8% drop to close at 654¢/kg cwt. The Eastern States Trade Lamb Indicator (ESTLI) posting a more modest 3% fall to finish the week at 663¢/kg cwt. Interestingly, we are now nearing the area we originally suggested the ESTLI was likely to bottom out once the Spring flush was competed.

Back in October we released an analysis piece suggesting the bottom would be found around the 630-650¢ level in late November. Granted, we are little late with the timing but its near enough now to call the bottom for the ESTLI given there can’t be too much more of the Spring flush to play out.

Victorian lamb yardings gaining 25% week on week to see 148,298 head recorded. This time last season the Victorian yardings peaked at 147,363 so it is fair to expect there can’t be much more lambs to come in the next few weeks. East coast lamb yardings boosted by the Victorian flow, registering just short of 300,000 head presented, to see the highest weekly total throughput since the start of the season – Figure 2.

A similar story for east coast mutton throughput too this week with a 15% gain in numbers week on week to see nearly 123,000 head yarded. A surprising number of sheep still being offered up, given the elevated yarding we have been seeing along the east coast since the middle of the year.

What does it mean/next week?:

The next week has some pretty good rainfall forecast for much of Victoria and Southern NSW, with up to 50mm expected across a broad area. This is likely to encourage any remaining stock to be held a little longer by producers so expect prices to stabilise and don’t be surprised to see a little kick higher as we head toward the Xmas break.