Half full or half empty. It depends on where you farm

The Australian east coast crop is a tale of two continents, with the bulk of NSW and QLD in a poor state, and Victoria/ East SA developing. The market is well and truly capturing the status of the crop, and the domestic market is pricing accordingly. This creates an issue of premiums being available (half full), but being unable to take advantage of them (half empty).

The Australian east coast crop is a tale of two continents, with the bulk of NSW and QLD in a poor state, and Victoria/ East SA developing. The market is well and truly capturing the status of the crop, and the domestic market is pricing accordingly. This creates an issue of premiums being available (half full), but being unable to take advantage of them (half empty).

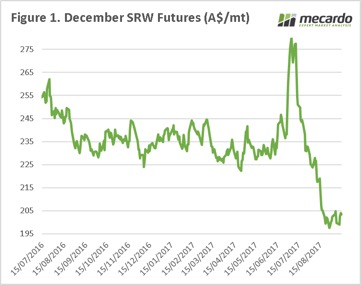

The futures market has been largely flat in spite of the release of the WASDE, the report had little in the way of surprises. The market has been trading in a narrow band between A$197 and A$205 for the past month (figure 1). The chart is a stark reminder of how quickly markets can move, with December swaps trading from a high of A$280 to a low of A$197 since the start of July.

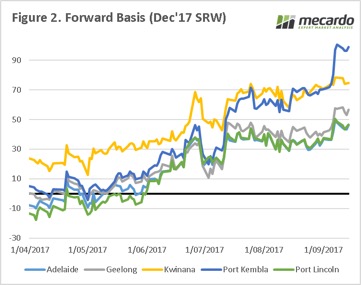

In the early part of the week, I spent time in NSW and had discussions with a number of grain brokers and agronomists. The NSW story is turning into a horror, according to all reports the damage from frost and the lack of in-season rainfall has likely reduced the bulk of potential from the crop. We can see this reflected in the market with Port Kembla basis levels (figure 2) continuing to maintain at historically high levels.

If a grower in Port Kembla had taken out a swap during the height of the July rally, then their overall price today would be >$370, which shows the value in strategic marketing using derivatives.

If a grower in Port Kembla had taken out a swap during the height of the July rally, then their overall price today would be >$370, which shows the value in strategic marketing using derivatives.

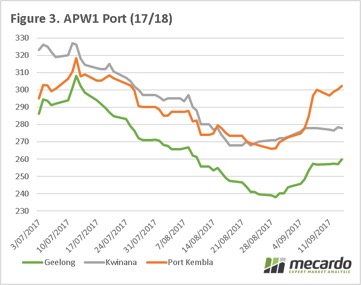

At a flat price level, I have taken the pricing for Kwinana, Geelong and Port Kembla (figure 3). We can see that Geelong and Port Kembla have seen strong rallies during September, whereas Kwinana has remained relatively flat. This is due to the domestic demand, largely in NNSW & QLD pricing strong premiums. At present SNSW & NVIC are pricing into the feedlots in the North.

Next Week/What does this mean?

The problem with having a premium basis level at the moment, is that it is on the back of poor cropping conditions, and so while some will benefit, many will not have the production to participate in the current strong market.

In the next week will we see the speculators continue to view the market as bearish, or will we start to see additional profit taking?

In the next week will we see the speculators continue to view the market as bearish, or will we start to see additional profit taking?