Heavy steers holding young cattle folding

It was a better week for rainfall, with sporadic showers across the country, but it didn’t help the young cattle market. The Eastern Young Cattle Indicator (EYCI) continued its fall this week, but there was some support for slaughter cattle.

It was a better week for rainfall, with sporadic showers across the country, but it didn’t help the young cattle market. The Eastern Young Cattle Indicator (EYCI) continued its fall this week, but there was some support for slaughter cattle.

The EYCI fell a further 10¢ this week to hit a 12 week low of 610.75¢/kg cwt. This price is not far off a 12 month low, and now around 7% below the same time last year. A small rise in yardings was likely responsible for the fall in the EYCI, but there might be some waning restocker and feeder demand.

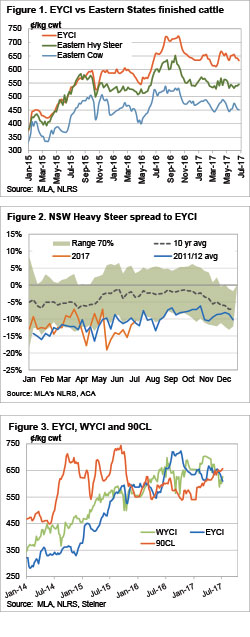

It doesn’t seem to be demand or supply of slaughter cattle which is sending the EYCI lower. Figure 1 shows that while the East Coast Heavy Steer price has reached the stratospheric level of last year, it hasn’t been falling in line with the EYCI lately.

Figure 2 shows that there is still some way to go for heavy steers to reach the ‘normal’ spread to the EYCI for this time of year. The NSW Heavy Steer has rallied from near a 20% discount to the EYCI to an 11% discount. The average for this time of year is 2%. If the spread returns to 2%, it will mean the EYCI has to fall to 560¢, or the Heavy steer will have to rise to 600¢.

Over in the West the slide in the Western Young Cattle Indicator has halted, and it even rallied a bit this week, finishing at 627¢/kg cwt.

The 90CL Frozen Cow Indicator was up 10¢ in a short week in the US to 656¢/kg swt. This is a 20 month high, and 9% stronger than this time last year. Processors are definitely doing a better job of keeping a lid on prices this winter.

The week ahead

Rainfall is forecast to again be sporadic, not really providing too much impetus for prices rises. The cold weather should start to bite on the finished cattle market, although with record cattle on feed, and rising grain prices we could see more cattle from that sector.

Young cattle supply doesn’t come from nowhere, and this is likely to support values in the short term. If the late winter and spring does fail however, the 550¢ mark is shaping as an initial target.