Kansas: The Phantom Menace

An interesting but frustrating week in the grain trade. At the start of the week newswires and social media were inundated with reports of general grievous damage to Kansas wheat crops caused by the force of snow and frost. In this week’s comment, we look at how the market responded locally and globally, and my views on being cautious in regards to the Kansas wheat tour results.

The background to the issues at the early part of this week are explained in Tuesdays analysis piece “It’s snow joking matter”, but in summary the speculators had a record net short, and the reports pouring out of Kansas spooked the market. The traders who were short, had to buy contracts to close their short positions fuelling a very strong rally.

The background to the issues at the early part of this week are explained in Tuesdays analysis piece “It’s snow joking matter”, but in summary the speculators had a record net short, and the reports pouring out of Kansas spooked the market. The traders who were short, had to buy contracts to close their short positions fuelling a very strong rally.

The rally can be seen in figure 1, which shows the spot market (and forwards) rising around 19¢/bu. The Kansas annual wheat tour also coincided with this week’s events, they performed a major croup tour stopping at 469 paddocks, and came up with a final yield estimate of 46.1 bushels per acre, which is below last year but above the five-year average. This announcement then caused the market to fall due to expectations that the weather events had largely caused little impact.

I would like to point out a few issues with the methodology used in this year’s crop update. Due to the snow event, the crop tour scouts were unable to perform any yield assessments. This therefore meant that the number of fields assessed reduced from 655 to 469 this year.

This yield estimate is therefore based on the fields with the smallest impact by recent weather, and yield/hectare losses will most likely be revised in the coming ten days. This may cause another short rally when the snow-covered fields are estimated, but likely the damage will not be as bad as previously expected.

This yield estimate is therefore based on the fields with the smallest impact by recent weather, and yield/hectare losses will most likely be revised in the coming ten days. This may cause another short rally when the snow-covered fields are estimated, but likely the damage will not be as bad as previously expected.

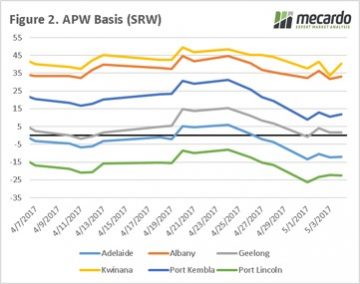

At a local level (figure 2) we can see that prices have risen during the last week by around $5-10 dependent upon port zone. The local rise has seen the West receive most of the rise in futures, however other port zones have not seen the full rise. The basis levels also received a small rise (figure 3), but a rise which must be tempered by the fact that the previous week had seen a sharp fall in all port zones.

What does this mean?

We need to keep a very close eye on the market as it may present selling opportunities over the 1-2 weeks, if (as I expect) the Kansas crop is re-estimated to take into account the snow-covered fields. This may potentially result in speculators with short positions being spooked again. The commitment of trader’s report for this week will be of interest as it will give an indication of whether the funds are still bearish on agricultural commodities or has this week made them reassess.

We need to keep a very close eye on the market as it may present selling opportunities over the 1-2 weeks, if (as I expect) the Kansas crop is re-estimated to take into account the snow-covered fields. This may potentially result in speculators with short positions being spooked again. The commitment of trader’s report for this week will be of interest as it will give an indication of whether the funds are still bearish on agricultural commodities or has this week made them reassess.

On Saturday morning (Aus time) the US non-farm payrolls will be released and if the we see the US economy recovering and the likelihood of further rate rises we could see further pressure on the A$. Furthermore, Thursday morning (Aus time) the USDA WASDE report will be released giving us another insight into the supply and demand fundamentals.