Lamb price modelling

We’ve been working on upgrading our lamb price forecasting abilities at Mecardo and have recently developed an interactive modelling tool that allows us to forecast the annual average level for the Eastern States Trade Lamb Indicator (ESTLI) based on key supply and demand inputs.

In this analysis we take the model through a test run, playing out a handful of scenarios for the next few years to see the potential impact on lamb prices.

The forecast model uses predictor inputs such as the Australian dollar level, annual Australian lamb slaughter levels and demand metrics based on per capita gross domestic product (GDP) measures from some of our key export destinations to forecast an annual average ESTLI level.

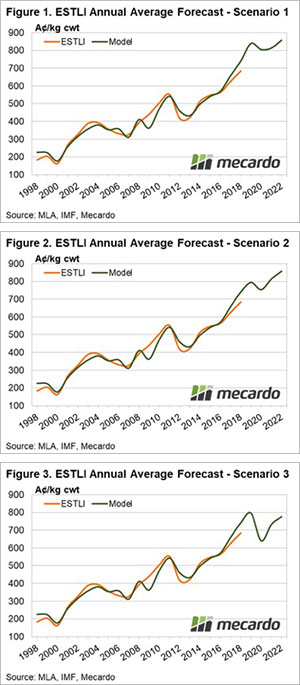

Figure 1 shows how the model compares to the actual ESTLI since 1998, including a forecast based on financial market consensus for the A$ level over the next few years, the Meat and Livestock Australia annual lamb slaughter estimates from their 2019 Sheep Industry projections and the GDP forecasts from the International Monetary Fund (IMF).

It suggests that growing wealth from offshore consumers will keep demand strong for our lamb exports and underpin prices for the ESTLI to see it average around 840¢ in 2019, dipping to 806¢ in 2020 as lamb slaughter rates in Australia increase.

However, we can adjust the lamb slaughter levels in the model to play out a second scenario that would test what the impact of a dry 2019/2020 will have on the ESTLI if slaughter rates increase from 21.5 million head in 2019 to 22 million head and if the 2020 lamb slaughter lifts from 22.1 million head to 23 million head – figure 2. The result of the increased slaughter is to see the ESTLI forecast for 2019 drop from 840¢ to 795¢ and the 2020 forecast decline from 806¢ to 755¢.

We can also imagine a third scenario where the increased lamb slaughter levels coincide with a shock to world growth levels during the 2020 season that limits the demand for lamb exports from our key offshore destinations. This could be in the form of a Chinese credit crunch impacting upon the Asian region and/or increasing US interest rates flowing through to softer global GDP growth levels.

Scenario three forecasts the ESTLI dip in 2020 extending further on the back of the decrease in offshore demand to see it average 640¢ before recovering back above 700¢ as GDP growth recovers beyond 2021 – Figure 3.

What does it mean/next week?

Interestingly, the model predicts a continuation of historically good price levels for lamb into the next few years even after we account for unforeseen problems such as an extended dry period within Australia, resulting in higher than expected slaughter levels, and/or a short-term hiccup to world growth and red meat demand.

Indeed, the model doesn’t forecast an annual average ESTLI below 600¢ in the next four years under any of the three modelled scenarios.

Key points:

- Price modelling for the ESTLI based on current MLA slaughter projections and global demand growth for lamb consumption estimates annual average prices above 800¢ for the next few years.

- Assuming a drier climate and higher slaughter than currently forecast will place the estimates for the 2019 and 2020 season into the 800¢ to 750¢ range.

- The inclusion of a demand shock due to falling growth levels could see the ESTLI annual average drop towards 650¢.