Like lambs to the slaughter.

The broad trend in East coast lamb and sheep slaughter numbers continue to be dominated by NSW and Victorian flows at the moment with a spike in lamb slaughter in the previous week, to levels well above normal, unable to dampen prices too vigorously. Similarly, elevated throughput along the East coast for both lamb and sheep was powerless to inhibit demand, particularly for mutton and Merino lamb.

The broad trend in East coast lamb and sheep slaughter numbers continue to be dominated by NSW and Victorian flows at the moment with a spike in lamb slaughter in the previous week, to levels well above normal, unable to dampen prices too vigorously. Similarly, elevated throughput along the East coast for both lamb and sheep was powerless to inhibit demand, particularly for mutton and Merino lamb.

The Eastern States Trade Lamb Indicator (ESTLI) closing slightly firmer, up 1.6% for the week at 607¢/kg cwt while the National Mutton Indicator surged higher, posting a gain of 6.4% to reach 431¢. A similar story for lamb and mutton in the West with the WATLI broadly trekking sideways to finish at 620¢ and WA Mutton up 1% to 420¢. East coast Merino Lamb the best performer this week of the lamb categories up 4.3% to close at 598¢/kg cwt.

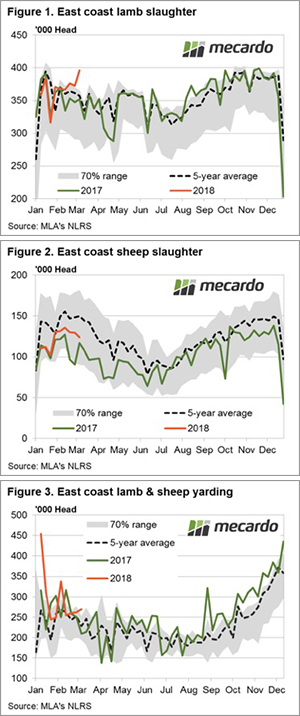

Figure 1 highlights the jump in lamb slaughter for the week ending 9th March to see levels on par with the Spring flush with over 396,000 head sent to processors. This reflects a 6.2% lift on the slaughter figures for the previous week and more than a 10% gain on what was sent to the meat works this time last season, or indeed what has been the seasonal average level for the last five years.

East coast sheep slaughter numbers continue to decrease week on week, trending below the five-year average pattern, but higher than this time last season – Figure 2. Indeed, the mutton slaughter levels reported for the week ending 9th March now sitting 8.7% under the February seasonal peak after successive declines for the past four weeks.

The combined East coast throughput levels for sheep and lamb creeping above the upper boundary of the normal seasonal band this week to break above the 70% range for the third time this year with 269,870 head reportedly changing hands at the sale yard, 18% higher than the average pattern for this time in the season – Figure 3.

What does it mean/next week?:

The relatively high historic prices being received by producers this season at the sale yard continues to attract supply, as identified by the high levels of sheep and lamb throughput shown in figure 3. Additionally, the high slaughter levels (particularly for lamb) we are seeing at the moment means that there’s a good chance there will be less available later into the season.

The fact that the high supply now isn’t having a huge impact upon prices is a good sign for producers, and the prospect of tighter availability later in the season will continue to keep prices robust. Although, into the shorter term the Easter break is just a fortnight away and this may see demand and prices soften a little as meat works look to reduce capacity or close for maintenance over the break.