Little data around but it’s all down for cattle.

Cattle sales were thin and far between this week, with only a few saleyards operating. The Thomas Foods International (TFI) fire won’t have as big an impact on cattle as it will on sheep, but we’ve already seen reports of weaker prices in the face of the uncertainty.

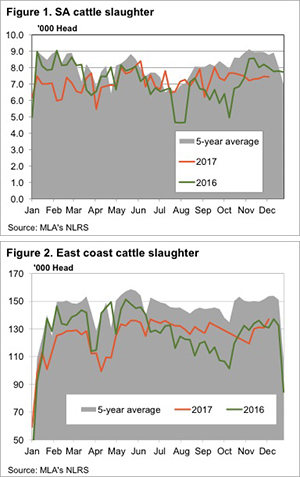

According to a report in ‘The Land’ last November TFI kill around 5,000 head of  cattle per week at Murray Bridge. While this is a very large, 65-70% of MLA’s reported weekly kill for South Australia (figure 1), it accounts for just under 4% of east coast slaughter (figure 2).

cattle per week at Murray Bridge. While this is a very large, 65-70% of MLA’s reported weekly kill for South Australia (figure 1), it accounts for just under 4% of east coast slaughter (figure 2).

With total slaughter back so far from the highs of the first half of 2016, TFI are likely to get their cattle slaughtered elsewhere to continue to supply customers. Basically, it seems unlikely that the cattle which now can’t be killed at TFI are going to flood into other markets and depress prices in general.

For those selling cattle at weaner sales in SA and Victoria the timing of the fire is not great. Uncertainty has been blamed in one report for weaners making 10-20¢ less than pre-Christmas sales. Still, prices of 300-335¢/kg cwt for 350kg calves is still good money.

While there has been a bit of rain about over the break, it wasn’t enough to see a lift in the couple of prime markets which were held this week. Casino and Dubbo both quoted prices down around 10¢/kg lwt across the board, but numbers were very limited.

The week ahead

There’s not a lot of rain on the forecast, and the Australian dollar has been rising, back up to 78¢. Both these fundamentals are bad news for cattle prices, as is the uncertainty created by the TFI fire. For better news, we can look to export markets, where demand traditionally picks up a bit in January, but this may take a few weeks to filter through.