Lower saleyard numbers help prices find a foothold

The Eastern States Trade Lamb Indicator (ESTLI) managed to climb 3.8% this week and East coast mutton wasn’t far behind, registering a 3.6% gain, as lighter throughput compared to this time last season lent some support to prices.

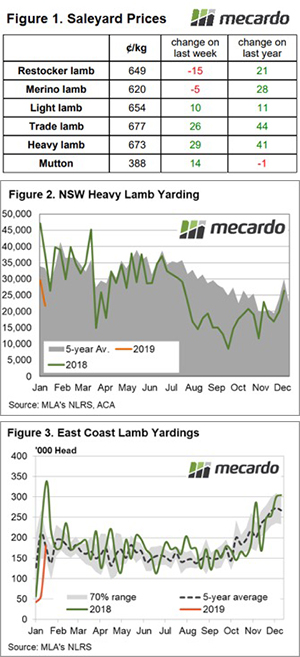

East coast Restocker lamb was one of the few categories to register a price drop, easing 2.3% as heatwave conditions sapped the buying enthusiasm out of restockers to see it close the week at 649¢/kg cwt. Merino lamb was the only other NLRS reported category along the East coast to suffer a price fall, albeit marginal at 5¢, to end the week at 620¢ (Figure 1).

Late last year we mentioned the prospect of a supply gap surfacing early into the new year and going by the price behaviour of heavy lamb this week, the star performer gaining 4.3% to 673¢, we could see the beginnings of a supply squeeze for heavy lamb.

Early throughput data for NSW Heavy lambs shows saleyard volumes for the first few weeks of January are trekking 40% below the 2018 pattern and 25% below the five-year average level (Figure 2). It would be interesting to see if this is being replicated across other states and probably worthy of a look in one of our sheep market analysis pieces for next week – keep your eyes peeled for that one.

Lower than average volumes also seemed to help give the ESTLI a leg up this week with a 26¢ boost to close at 677¢/kg cwt. East coast lamb throughput levels are running 28% lower than for the same period in 2018 and 17% under the five-year seasonal average since the start of 2019 (Figure 3).

What does it mean/next week?:

There is some very light rain forecast for southern parts of the country next week, but not enough to really get a rocket up lamb and sheep prices. A more likely scenario will see prices respond to supply volumes, with continued weak supplies helping to support gradual price gains.